Navigation: Pay | Payroll Transaction Configuration

Accumulators track payroll totals for reporting and calculations

An accumulator is a running total of a pre-defined category of data. That data may be in money or hours.

These data categories feed calculations for other transactions that depend on them.

Jemini stores accumulator data against transactions that relate to points in time. This means amounts can be queried at any timeframe.

You connect a transaction to an accumulator through the transaction’s applicability.

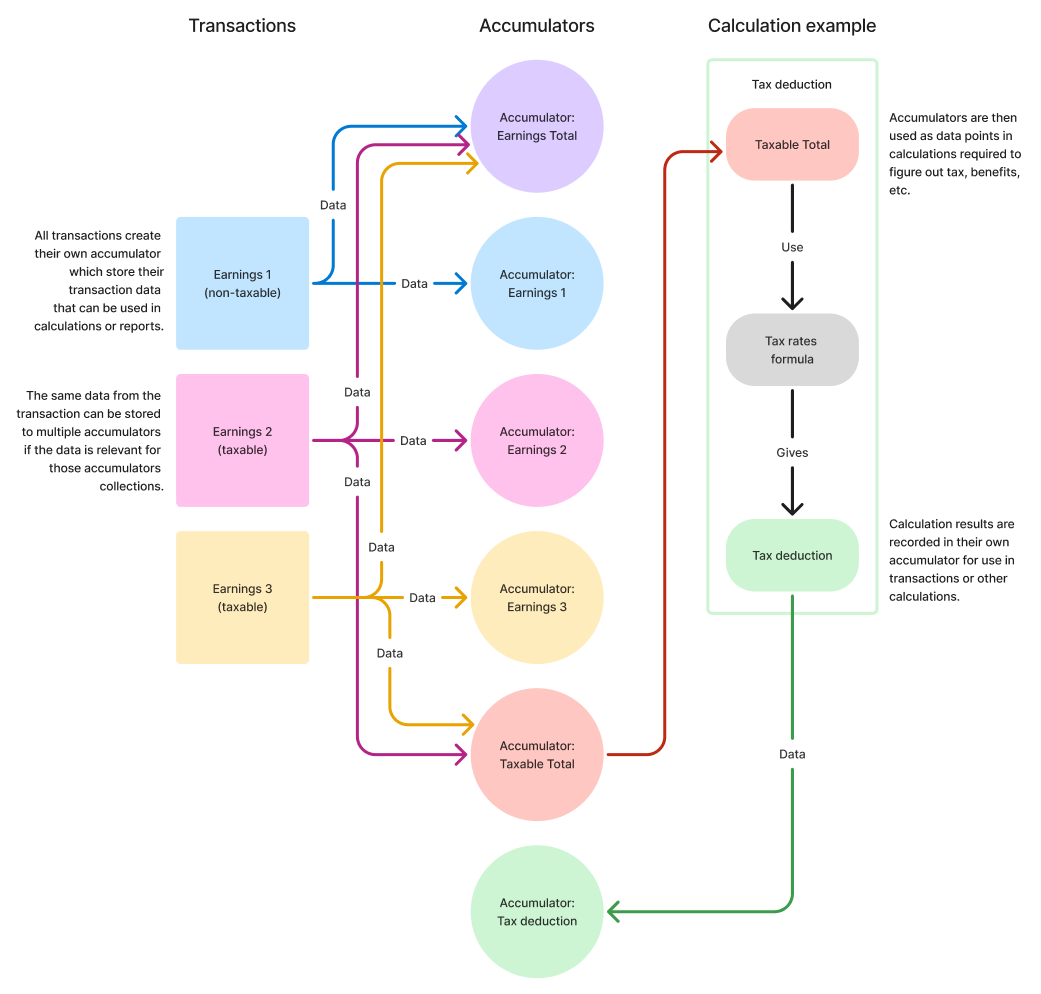

Accumulators collect transaction amounts and calculation results

Accumulators use the money or hours data from the transactions that reference them. Accumulators also store the results from calculations Jemini performs.

Calculation rules use these accumulators to work out tax amounts, leave entitlement, net pay, and other payroll calculations.

Each transaction creates its own accumulator plus any required ones

Most accumulators already exist in Jemini, but when you create a transaction, it also creates an accumulator for itself.

Diagram of accumulator function

Accumulators by Transaction Type

Below is the list of accumulators by transaction type for both Australia and New Zealand, Australia only, and New Zealand only. The table indicates in green whether the accumulator is:

Included by default: Jemini will automatically add these to the transaction. You can remove them if necessary.

Must be included: Jemini will automatically add these to the transaction. You can’t remove them.

Subtracts from total: Deducts the accumulated amount from the total amount (rather than adds to it).

Accumulators by Transaction Type for Australia and New Zealand

Transaction Type | Accumulator Name | Included by default | Must be included | Subtracts from total |

|---|---|---|---|---|

Employee Super | Employer Super | |||

Leave PAYG payments | Total Taxable | |||

Leave payments | Leave Payments | |||

Leave payments | Total Taxable | |||

Mandatory after-tax deduction | Mandatory after-tax deduction | |||

Mandatory after-tax deduction | Total Deductions excluding tax | |||

Mandatory after-tax deduction | Total Deductions including tax | |||

Non-paying transaction | Information | |||

Non-taxable allowance | Non-taxable allowance | |||

Non-taxable allowance | Total Non-Taxable Payments | |||

Non-taxable reimbursement | Non-taxable reimbursement | |||

Non-taxable reimbursement | Total Non-Taxable Payments | |||

On cost | On Cost | |||

Pre-tax deduction | Pre-tax deduction | |||

Pre-tax deduction | Total Deductions including tax | |||

Pre-tax deduction | Total Taxable | |||

Tax deduction | Tax deduction | |||

Tax deduction | Total Deductions including tax | |||

Taxable allowance | Taxable Allowance | |||

Taxable allowance | Total Taxable | |||

Taxable earnings | Taxable Earnings | |||

Taxable earnings | Total Taxable | |||

Termination | Total Taxable | |||

Voluntary after-tax deduction | Total Deductions excluding tax | |||

Voluntary after-tax deduction | Total Deductions including tax | |||

Voluntary after-tax deduction | Voluntary after-tax deduction |

Accumulators by Transaction Type for Australia only

Transaction Type | Accumulator Name | Included by default | Must be included | Subtracts from total |

|---|---|---|---|---|

Leave payments | AU Additional Payment | |||

Leave payments | AU Ordinary Pay LSL ACT | |||

Leave payments | AU Ordinary Pay LSL NSW | |||

Leave payments | AU Ordinary Pay LSL NT | |||

Leave payments | AU Ordinary Pay LSL QLD | |||

Leave payments | AU Ordinary Pay LSL SA | |||

Leave payments | AU Ordinary Pay LSL TAS | |||

Leave payments | AU Ordinary Pay LSL VIC | |||

Leave payments | AU Ordinary Pay LSL WA | |||

Leave payments | AU Protected Net Earnings | |||

Leave payments | Ordinary Time Earnings (SGC) | |||

Lump Sum | AU Additional Payment | |||

Pre-tax deduction | AU Employee Super | |||

Pre-tax deduction | AU Protected Net Earnings | |||

Tax deduction | AU Protected Net Earnings | |||

Taxable allowance | AU Additional Payment | |||

Taxable allowance | AU Car | |||

Taxable allowance | AU Ordinary Pay LSL ACT | |||

Taxable allowance | AU Ordinary Pay LSL NSW | |||

Taxable allowance | AU Ordinary Pay LSL NT | |||

Taxable allowance | AU Ordinary Pay LSL QLD | |||

Taxable allowance | AU Ordinary Pay LSL SA | |||

Taxable allowance | AU Ordinary Pay LSL TAS | |||

Taxable allowance | AU Ordinary Pay LSL VIC | |||

Taxable allowance | AU Ordinary Pay LSL WA | |||

Taxable allowance | AU Protected Net Earnings | |||

Taxable allowance | Ordinary Time Earnings (SGC) | |||

Taxable earnings | AU Additional Payment | |||

Taxable earnings | AU Ordinary Pay LSL ACT | |||

Taxable earnings | AU Ordinary Pay LSL NSW | |||

Taxable earnings | AU Ordinary Pay LSL NT | |||

Taxable earnings | AU Ordinary Pay LSL QLD | |||

Taxable earnings | AU Ordinary Pay LSL SA | |||

Taxable earnings | AU Ordinary Pay LSL TAS | |||

Taxable earnings | AU Ordinary Pay LSL VIC | |||

Taxable earnings | AU Ordinary Pay LSL WA | |||

Taxable earnings | AU Protected Net Earnings | |||

Taxable earnings | Ordinary Time Earnings (SGC) | |||

Termination | AU Termination Pay | |||

Termination | AU Termination Pay PAYG | |||

Termination | AU Termination Pay Tax Free | |||

Voluntary after-tax deduction | AU Employee Super |

TIP

Australian State LSL Accumulators: Each Australian state has different Long Service Leave legislation requirements. Select the accumulator that matches the employee's work location. For example, NSW and VIC have 7-year entitlements while other states vary.

Accumulators by Transaction Type for New Zealand only

Transaction Type | Accumulator Name | Included by default | Must be included | Subtracts from total |

|---|---|---|---|---|

Employee Super | NZ Super Employer | |||

Leave PAYG payments | Leave PAYG payments | |||

Leave PAYG payments | NZ Extra Pay | |||

Leave PAYG payments | NZ Gross Earnings Annual Holiday | |||

Leave PAYG payments | NZ Gross Earnings BAPS | |||

Leave PAYG payments | NZ Include in Super calculation | |||

Leave PAYG payments | NZ Ordinary weekly pay 4 week | |||

Leave payments | NZ ACC Payments after first week | |||

Leave payments | NZ ACC payments first week | |||

Leave payments | NZ Extra Pay | |||

Leave payments | NZ Gross Earnings Annual Holiday | |||

Leave payments | NZ Gross Earnings BAPS | |||

Leave payments | NZ Include in Super calculation | |||

Leave payments | NZ Ordinary weekly pay 4 week | |||

Pre-tax deduction | NZ Include in Super calculation | |||

Pre-tax deduction | NZ Super Employee | |||

Taxable allowance | NZ ACC Payments after first week | |||

Taxable allowance | NZ ACC Payments first week | |||

Taxable allowance | NZ Gross Earnings Annual Holiday | |||

Taxable allowance | NZ Gross Earnings BAPS | |||

Taxable allowance | NZ Include in Super calculation | |||

Taxable allowance | NZ Ordinary weekly pay 4 week | |||

Taxable earnings | NZ ACC Payments after first week | |||

Taxable earnings | NZ ACC Payments first week | |||

Taxable earnings | NZ Gross Earnings Annual Holiday | |||

Taxable earnings | NZ Gross Earnings BAPS | |||

Taxable earnings | NZ Include in Super calculation | |||

Taxable earnings | NZ Ordinary weekly pay 4 week | |||

Voluntary after-tax deduction | NZ Super Employee |