Here's what's new in Jemini

Discover the newest features, enhancements, and fixes.

Version 32.0.13 went live in production on 12 December 2025. Most of you are still running the previous versions, while a few already have the update. Your account manager will have let you know if you've been upgraded.

If you have questions or would like help with any changes, feel free to raise an iHelp through Infusion – we’re here to help!

In this release:

We've packed Jem 32 with new features, improvements, and fixes to make your payroll easier to manage.

You don't need to do anything – we'll apply these updates automatically. Once they're live, you can start using the new features and improvements right away.

Some versions were urgent fixes for specific customers. We roll them out to everyone in subsequent releases, so you all get the same reliable experience. For example, Versions 32.0.0 to 32.0.12 are included in the 32.0.13 release.

Version 32.0.13

What's new in People

Leave Management

Email links for leave requests now take managers directly to the specific leave event

When you're already signed into Jemini and receive a leave request email notification, click the link to go straight to that event. Jemini applies the right filters and scrolls it into view, so you don't need to manually search the team leave page.

(JEM-24468)

What’s fixed

Leave Management

Customer-raised

Leave balance calculations show the "balance after" value when viewing pending leave requests in Team Leave (JEM-24762, JEM-23179)

Leave liability and termination payments calculate when an employee's annual leave anniversary date is before their commencement date (JEM-23970)

You can now enter specific hours when partially reversing a leave request (JEM-24913)

Pay and Payroll Processing

Customer-raised

Extra pay tax on final pay uses the correct tax rate for terminating employees who have historical earnings. Jemini includes all pay periods with taxable earnings when calculating the rate (JEM-24883)

Found during internal testing

Pay Transaction Import no longer crashes when importing leave events from external systems (JEM-24879)

Employee Management

Customer-raised

Rehired employees using Multiple Employments can be linked to their user profile (JEM-24189)

API (Application Programming Interface)

Found during internal testing

The Employee API returns success responses when employee updates save properly instead of showing an External ID error message even though changes had saved (JEM-24881)

Version 32.0.12 – Released to one specific customer only

Fixes

What we fixed in Jem 32.0.12

Customer-specific fix: Add future leave requests after transitioning between leave plans without receiving a "No active leave plans found for the selected dates" error when the leave plans weren't linked together (JEM-25075)

Version 32.0.11 – Released to one specific customer only

Fixes

What we fixed in Jem 32.0.11

Customer-specific fix: Creating leave events through the API now works when the leave plan name is omitted or when an employee's agreed working hours don't divide evenly into their agreed working days (JEM-24900, JEM-24928)

Customer-specific fix: When you import leave transactions from CSV files, Jemini now creates both the leave events and their corresponding pay transactions. Previously, Jemini would create the leave events but miss the pay transactions (JEM-25033)

Customer-specific fix: Leave event imports no longer fail when processing records with missing leave request type information (JEM-24979)

Version 32.0.8 - 32.0.10

Fixes

What we fixed in Jem 32.0.10

IRD employment information files now submit successfully to Inland Revenue (JEM-25159)

Version 32.0.5 - 32.0.7

Fixes

What we fixed in Jem 32.0.7

IRD file submissions now work correctly after fixing the certificate configuration that was blocking employment information files from reaching Inland Revenue (JEM-25159)

Version 32.0.4

IRD test environment certificate update

We've updated the test environment certificate for IRD payday filing

The IRD test environment certificate has been renewed and updated in Jemini to maintain secure communication with Inland Revenue's Gateway Services during payday filing operations.

(JEM-25068)

Version 32.0.3 – Released to one specific customer only

Fixes

What we fixed in Jem 32.0.3

Customer-specific fix: When multiple employees have manager roles in the same position establishment, all managers now receive email notifications about pending leave requests. Previously, only one manager received the notification (JEM-24912)

Version 32.0.2

What’s new in Pay

Pay Reporting Enhancements

Employee Pay Details report now includes future-dated and terminated employees with filtering options

The report adds an Employment Status column that lets you filter between current, future, and terminated employees. Future employees show with their upcoming start dates, which is helpful when you need to prepare for incoming employees. Terminated employees appear with their most recent bank account details.

(JEM-24775, JEM-24940)

We’ve created a selection of new pay reports and updated existing ones to cover longer periods of current and historical data

The reports with current data now cover the past 2 months, while the reports with historical data extend to the past 36 months. With these extra months of data, you'll be able to spot trends, reconcile pay more accurately, and create detailed reports that meet compliance needs.

NEW reports with current data covering the past 2 months:

Direct Credit Check Current

Pay Transaction Current

Pay Variance Current

NEW reports with historical data covering the past 36 months:

Direct Credit Check History

Employee Pay Costing Historical

Pay Transaction History

Pay Variance History

UPDATED reports with historical data covering the past 36 months:

Cost Centre Pay

Hours Worked Analysis (found in People > Reporting)

Note for system administrators: To give users access to these reports, you must add them to the relevant Security Profiles. Learn how in How to give users access to new reports.

(JEM-22894)

Payroll Processing Performance Enhancements

You can now process large payrolls faster and more reliably

When processing payroll for organisations with thousands of employees, Jemini now handles the workload much more efficiently. We've improved how the system prepares employee pay data, processes calculations, and handles large batches of transactions.

These improvements mean you won't see timeouts or long delays when calculating pay for all employees, especially if you're managing complex payroll scenarios with many cost centres and pay transactions.

(JEM-19916, JEM-19939, JEM-19945, JEM-19950)

Warning acknowledgment and pay mode access work faster for large organisations

When you're reviewing payroll warnings and need to acknowledge multiple issues, Jemini now responds immediately instead of taking several minutes to process your actions. Opening individual employee pay modes also loads much faster, even after processing multiple pay cycles with extensive transaction histories.

(JEM-19941, JEM-20336)

Pay Transaction Applicability Enhancements

Pay Transaction Applicability panels now open and update without delays

If you previously experienced long wait times when opening Pay Transaction Applicability dialogs or updating applicability records, these performance issues have been resolved. Jemini now responds quickly when you're configuring transaction rules, even for organisations with extensive payroll setups.

(JEM-19936, JEM-19937)

What’s new in People

Employee Termination Enhancements

Clearer warning message for future-dated terminations

When you set a termination date in the future, you'll see: ‘The termination date is in the future. If you still need to process pay cycles leading up to that date, the final pay may change.’ This replaces the previous confusing message.

(JEM-24715)

People Reporting Enhancements

Employee Work Pattern report now includes work pattern notes

The Employee Work Pattern report now shows any notes you've added to work patterns to give you more context when reviewing employee schedules and arrangements.

(JEM-24561)

What’s new in Business

Business Reporting Enhancement

The Position Establishment vs Occupancy FTE report now uses clearer labels and a new colour code to show vacancy status

When a position has no employees assigned, the report displays ‘Approved - Vacant’ instead of the previous ‘Approved - Occupied’ label. Positions that are partially filled now show as ‘Partial Vacancy’ with a new blue colour code, making it easier to distinguish between completely vacant positions and those with some staff but not at full capacity.

(JEM-25036)

What else is new

Importing Functionality Enhancements

Importing pay transactions through our API now performs better with large datasets

We've optimised the One-off Transaction Import API to handle bulk transaction imports more efficiently. Jemini now uses better database queries and improved data processing methods, which reduces import times and prevents performance bottlenecks when processing large volumes of transactions.

You can now import cost centre codes as part of your pay transaction data, giving you more control over how transactions are allocated across your organisation structure.

(JEM-19946, JEM-19952, JEM-20411, JEM-20676, JEM-20576, JEM-21002, JEM-21060)

Fixed Value Import API documentation is now improved

We've enhanced the documentation for the Fixed Value Import API to make it clearer how to use this functionality effectively in your payroll integrations.

(JEM-20909, JEM-20763)

What’s Fixed

Fixes for issues raised by customers

Leave

Sick leave hourly rate now calculates correctly when using Average Daily Pay or Relevant Daily Pay instead of dividing by total leave hours (JEM-24423)

Pay Transaction Import

Pay transaction imports now work when the transaction dates are from already-closed pay periods (JEM-24876)

Reporting

Employees with occupancy changes now appear correctly in scheduled Leave Liability reports when their occupancy record ends on the report date (JEM-24469)

Power BI reports now display dates in DD/MM/YYYY format instead of American MM/DD/YYYY format (JEM-24217, JEM-24644)

Super Funds

Employer Contribution Rate field is now available when setting up Super Fund records, restoring functionality that was missing after the JEM 32 upgrade (JEM-24848)

Fixes for issues found during internal testing

Some of these issues were found in testing environments and were caught before reaching production.

API (Application Programming Interface)

The Leave Event API now properly excludes public holidays from leave calculations, matching how leave works when you add it manually and preventing overpayment (JEM-23807)

Leave Event API requests using dailyLeaveEvents field no longer return server errors and work correctly for both single and multi-day leave scenarios (JEM-24847)

Employment occupancy API requests now work correctly instead of returning server errors (JEM-24884)

Payroll Calculations

Average Weekly Earnings calculations now properly reduce the number of weeks when employees take unpaid leave longer than one week (JEM-24870)

Payroll Setup

Pay date offset error messages when setting up a pay period now show the correct numeric range instead of displaying "{1}" placeholder text (JEM-24830)

Public Holiday Pay

Salaried employees' public holiday pay amounts now appear straight away instead of showing $0 and an error message when you first view their pay cycle (JEM-24829)

Organisation Components

Organisation details like legal entities and bank accounts now stay intact when saving changes. Recently, these were disappearing after organisation configuration updates, causing direct credit files to fail (JEM-24708)

Version 32.0.1 – Released to one specific customer only

Fixes

What we fixed in Jem 32.0.1

Customer-specific fix: Ordinary Weekly Pay calculations show the correct dollar amounts instead of $0 for leave taken before your payroll active date (JEM-24770)

Version 32.0.0

New feature: Australian Payroll

We’re introducing brand new Australian payroll functionality in this release. To see what’s included, check out the Australian payroll release notes – special edition (Jem 32.0.0).

What’s new in Pay

New feature: Payroll Management

The new Payroll Management interface makes it easier to select payrolls, pay periods, and manage pay.

The Payroll Management bubble replaces the Pay Cycles bubble in Pay. You can still perform all the same tasks as before, but now it’s simpler and more intuitive. For example, clickable functions have replaced the rollers for selecting payrolls and pay periods.

To access Pay Cycles, open Payroll Management, choose the relevant payroll and pay period, then select a payroll information card. The functions in Pay Cycles work the same as before, only the navigation has changed.

Navigation: Pay > Payroll Management.

Note for system administrators: To give users access to this feature, open their Security Profile and enable the ‘Payroll Management application’ under ‘Payroll Processing' permissions in ‘Payroll’.

(JEM-23292)

Payroll Setup Enhancements

Edit cost codes on Jemini-generated payroll transactions that were previously locked

Payroll transactions marked with the Jemini icon were previously locked from editing. Now you can update the credit and debit cost codes for these transactions while keeping other settings protected. This means better flexibility for cost accounting without compromising the integrity of Jemini-generated transactions.

(JEM-23303)

New warning helps you spot data conflicts when changing payroll active dates

When you update a payroll active date, you'll now see a warning if regular transactions exist before the selected date. This helps you make informed decisions about potential data conflicts.

(JEM-23666)

Managing multi-country setups is now easier with payroll active country controls

You can now activate or deactivate countries in your payroll setup, which controls what country-specific data appears throughout Jemini. When a country is inactive, its super funds, transaction codes, leave plans, and holidays won't show in dropdown lists or reports.

(JEM-24052)

Payroll Transaction Configuration Enhancements

When you update a payroll transaction applicability to create a future record, Jemini will copy all details from the current record

Previously, only some details were carried over. This enhancement enables you to maintain consistency, reduce manual data entry, and minimise errors, particularly when managing complex payroll configurations.

(JEM-23523)

More calculation options now available for employer superannuation transactions

When configuring 'Employer Super' payroll transactions, you can now select from multiple calculation types including Fixed Value. This gives you more flexibility to set up different types of employer super contributions using the calculation method that best suits your needs.

(JEM-23239)

System payroll transactions won't automatically attach when they shouldn't

Core payroll transactions now have better default settings, so they won't unexpectedly appear in employee Pay Modes unless you actually need them there.

(JEM-23232)

We’ve removed some unnecessary accumulators that Jemini was automatically adding to NZ Business Leave (590) transactions

This enhancement reduces the need for manual corrections and only impacts customers using the NZ Business Leave functionality.

Accumulators removed: Kiwisaver Exempt, NZ ACC Payments after first week, NZ ACC Payments first week, and NZ Include in Super Calculation.

(JEM-22766)

Payroll Processing Enhancements

Pro rata calculations now consider payroll connection dates for employees moving between payrolls

Jemini now calculates salary and hourly pay based on the actual days an employee was connected to each payroll. This improves accuracy when employees move between payrolls with different pay frequencies during a month.

(JEM-21222)

Better validation helps prevent duplicate tax transactions in employee payroll

Jemini now detects when multiple tax transactions have been created for the same employee in a pay period. You'll see an error message if duplicate PAYE or PAYG transactions exist, which helps maintain payroll data integrity when opening Pay Mode or running pay cycles.

(JEM-23815)

You can now see and select pay periods before the payroll active date that were previously hidden

When you need to recalculate historical data after moving your payroll active date, you can now access and process these earlier pay periods in the Payroll Management view. This is particularly useful when performing data fixes and means you don't have to go into each employee's Pay Mode individually.

(JEM-23920)

Better validation helps catch Net Pay transaction problems before processing payroll

Jemini now checks that each employee has exactly one Net Pay transaction when you open Pay Mode or run pay cycles. You'll see error messages if Net Pay transactions are missing or if there are duplicates, helping prevent payroll calculation issues.

(JEM-23767)

We've implemented better tax calculations for backdated overtime transactions

When you add overtime for previous pay periods, Jemini now validates the dates and applies the correct tax calculations for the historical period.

(JEM-23089)

When processing NZ payroll, you'll now get alerts for KiwiSaver transaction problems

If there are issues with KiwiSaver employer contributions, employee contributions, or ESCT transactions, you'll see validation warnings that help you fix these problems before finalising the payroll.

(JEM-23998)

Pay Reporting Enhancements

Employee Pay Calculation and Pay Calculation Summary reports now show cash out details

We've added an "Is Cash Out" column to both the Employee Pay Calculation Report and Pay Calculation Summary Report. This helps you quickly identify which payments were processed as cash outs versus regular payments, making it easier to track different payment methods for your employees.

You'll find this new column displays whenever there are cash out transactions in the selected pay period.

(JEM-23743, JEM-23742)

Cost Centre Pay report refreshes properly when you change filters

The Cost Centre Pay Report now updates correctly when you change your filter selections. Previously, the report would sometimes show outdated information after changing filters, but now it refreshes immediately to show the right data for your selected criteria.

(JEM-24273)

You can now set the Leave Balance and Leave Liability reports to run at the end of the current pay period

Two new application settings allow these reports to update every night to reflect the end of the current pay period.

Application settings:

Leave Liability Extract By Pay Period (Default = ‘No’)

Leave Balance Extract By Pay Period (Default = ‘No’)

To enable these settings, change the default value to ‘Yes’ in the System application settings.

(JEM-22462)

We’ve updated the Leave Liability and Leave Balance reports to cater to Multiple Employments enhancements

Leave entitlements are now displayed at an employment level for each employment stream.

(JEM-21354)

You can now filter Employee Leave Plan Listing reports by balance amounts

We've added three new balance filters to the Employee Leave Plan Listing report: Entitlement Balance In Hours, Accrued Balance In Hours, and Total Balance. You can now choose to show all leave plans (including those with zero balances) or filter to see only plans with specific balance ranges. This makes it easier to check that all correct leave plans are attached to employees, especially after data migrations.

(JEM-24418)

What’s new in People

New Feature: Reordered Layout for Action Bubbles

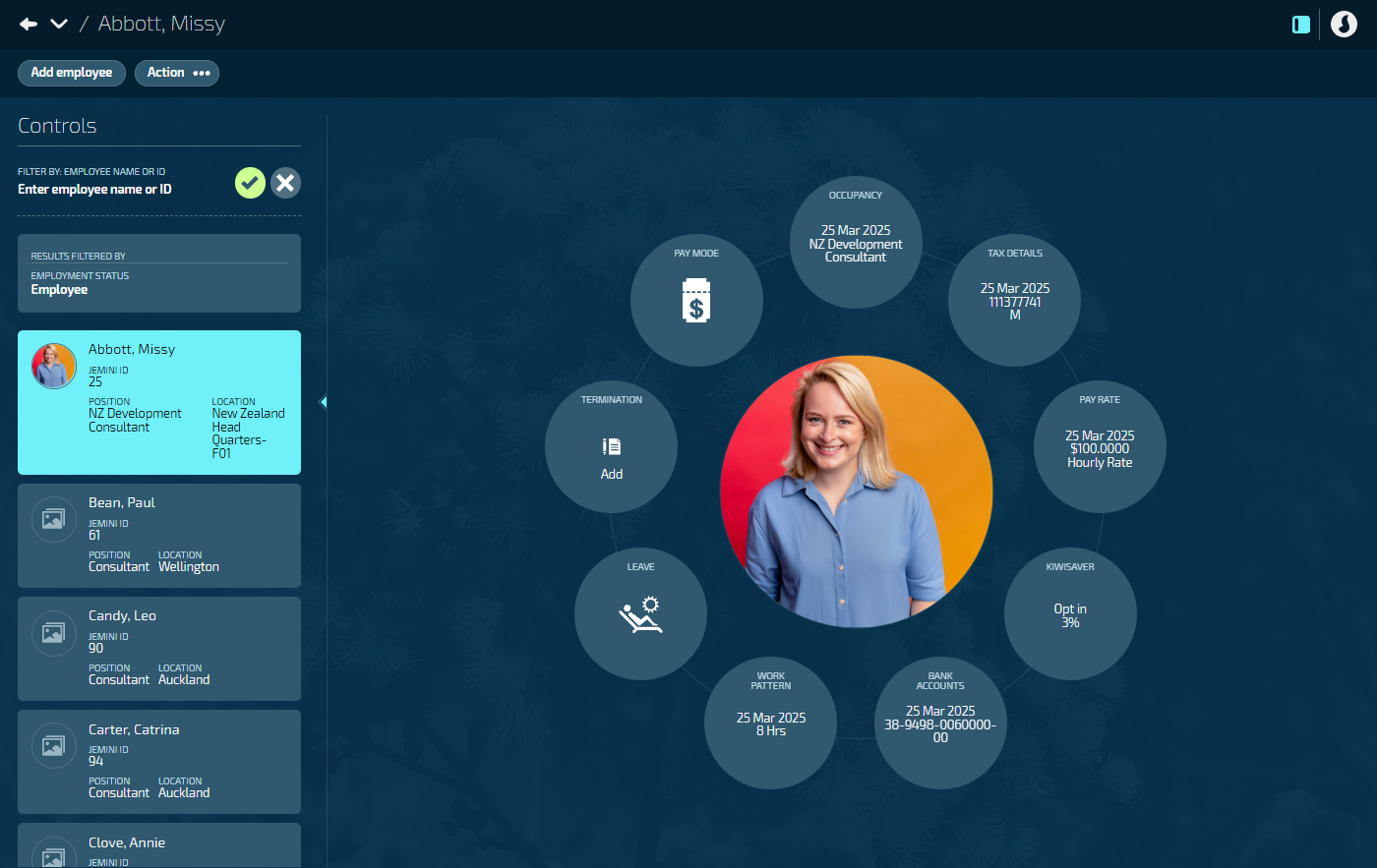

Action bubble layout now follows employee lifecycle

We’ve moved KiwiSaver and Pay Mode to arrange each action in a clockwise pattern, matching the steps you take when adding a new employee. Start at the 12 o’clock position with Occupancy, then work clockwise to add Tax Details, Pay Rate, KiwiSaver, Bank Accounts, Work Pattern, and Leave records. Termination follows these steps as it's the last stage in an employee's lifecycle. Pay Mode remains separate due to its distinct nature from the other actions.

Leave Management Enhancements

Leave plan updates now show clearer warnings about affected leave events

When you update leave plan settings that affect existing employee leave, Jemini shows you exactly which leave events will be changed and why. The warning messages are more detailed so you can understand the impact before saving your changes.

(JEM-23985)

Employee Action Enhancements

Update costing and other non-payroll details even after pay cycles have been processed

When employees have been paid and their occupancy records are normally locked for editing, you can now update certain details that don't affect payroll calculations. This includes position establishment, level, organisation structures, employment category, occupancy function, organisation, and costing information.

This change helps you keep employee records accurate without needing data fixes when organisational changes happen after payroll has been processed. Payroll-related fields like location, hours, and leave settings remain protected to maintain pay cycle integrity.

(JEM-23929)

Reactivate historical employee records by clearing their end dates

If you have historical employee records (like occupancy, pay rates, bank accounts, work patterns, KiwiSaver, or super fund details) and there's no current record, you can now edit the end date to make that historical record current again. This helps when you need to reactivate expired employee details without creating duplicate records.

You'll be able to edit the end date field for the most recent historical record when there's no current record available for that employee.

(JEM-24108)

Faster loading when working with employee positions and payroll data

New database indexes speed up common tasks when you're viewing or updating employee positions and pay information. These performance improvements happen automatically in the background.

(JEM-23398)

Onboarding Enhancements

Onboarding tasks now filter by payroll country

New Zealand and Australian payroll processes have different requirements, so onboarding tasks now show only what's relevant for each employee's payroll country. This reduces confusion and helps you focus on the right compliance steps for each region.

(JEM-24297)

Multiple Employments Enhancements

Jemini now protects you from reversing employment terminations after final pay for employees with multiple employments

If you try to reverse an employment termination for someone with multiple employments after they've already received their final pay, Jemini will stop you and show a message explaining why. This prevents accidental double payments and keeps your payroll accurate.

(JEM-22537, JEM-22650)

We've improved termination date validation for employees with multiple employments

When terminating employment streams, you'll get clearer warnings if the termination date falls on weekends or business leave days.

(JEM-22548)

Employee Pay Rate Enhancements

Clearer labeling and safer defaults prevent confusion when adding hourly pay transactions in employee pay rates

The 'Add Hourly Pay Transaction to Pay Mode' option in employee pay rates (previously called 'Add Hourly Pay Transaction When Saving Pay Rate') now defaults to No and uses clearer wording. This helps prevent accidentally adding unwanted hourly pay transactions and makes it obvious that the transaction will be added to the employee's Pay Mode.

(JEM-23577)

Tax Detail Enhancements

To help you set up tax details accurately, we’ve added a warning message that appears when you select ‘Use ESCT rate determined by system’ as your ESCT rate option

This warning explains that this option should only be used for new employees who haven’t completed a full tax year of service, as the system-calculated rate may not reflect their actual earnings history.

(JEM-23060)

Super Fund Enhancements

You can now edit or remove an end date on the latest employee Super Fund records

The end date used to be locked. Now these records function like other similar records in Jemini, keeping things consistent.

(JEM-22145)

Leave Enhancements

You can now select the date when entering leave balance adjustments

Before, the date was always set to today when you entered leave balance adjustments. Now you can change the date to match when the adjustment actually happened. This makes it much easier to keep your leave records accurate.

(JEM-24137)

Date picker replaces date roller in employee leave balance view

Selecting dates for leave balance enquiries is now simpler with a standard date picker instead of the previous date roller interface.

(JEM-24093)

Leave plan field now says "Attach plan to all employees" instead of "Available to All"

We've updated the field label to be clearer about what it actually does. When you tick this option, it automatically attaches the leave plan to all employees in your organisation, rather than just making it available for selection.

(JEM-23337)

When you make changes to historical leave records, Jemini now recalculates leave balances more accurately

Your employee leave balances will stay correct even when you update historical leave data.

(JEM-23684)

Leave balances calculate faster and more reliably

When you're working with employee leave balances, the calculations now happen more quickly and consistently.

(JEM-23690)

Better support for leave balance adjustments and recalculations

Leave balance processing now handles imports, deletions, and adjustments more reliably. When you make changes to historical leave data, Jemini automatically recalculates affected balance periods to keep everything accurate.

You'll also get clearer validation messages when importing leave balance data, particularly around service duration and hours worked calculations.

(JEM-23960, JEM-24318)

People Reporting Enhancements

Leave Metrics Analysis Report displays correctly for all employment scenarios

We've fixed display issues with the Leave Metrics Analysis Report that were causing problems in certain employment scenarios. The report now shows accurate leave data consistently, regardless of your specific employment setup or leave configurations.

(HD-23833)

What’s new in Business

Position Establishments Enhancements

You can now edit or remove an end date on the latest Position Establishment records in the Position Chart

The end date used to be locked. Now these records function like other similar records in Jemini, keeping things consistent.

(JEM-21982)

Business Reporting Enhancements

The Position Establishment vs Occupancy FTE report now has new columns to give you more options for reporting by organisation structure

On the ‘Position Establishments & Occupancies’ tab, you’ll now see extra columns for ‘Position Org Structure’, similar to the existing ‘Occupancy Org Structure’ columns. These columns are:

Position L1 Org Structure Component

Position L1 Org Structure Type

Position L2 Org Structure Component

Position L2 Org Structure Type

Position L3 Org Structure Component

Position L3 Org Structure Type

Position L4 Org Structure Component

Position L4 Org Structure Type

Position L5 Org Structure Component

Position L5 Org Structure Type

You can also filter the data by both sets of organisation structure levels in both tabs, making it easier to analyse full-time equivalent (FTE) data.

(JEM-22938)

What’s new in System

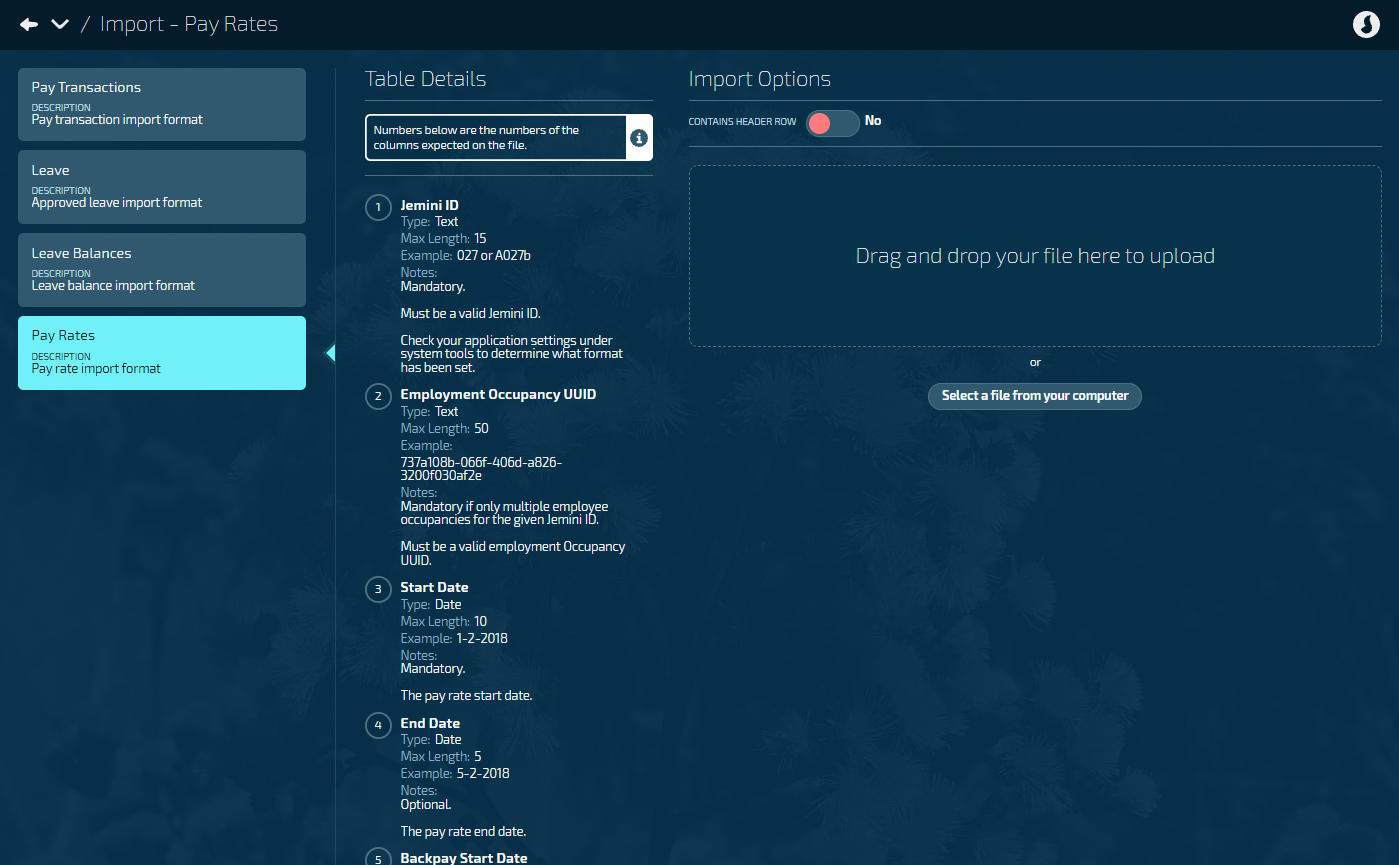

New Feature: Bulk Import Pay Rates

You can now bulk import employee pay rates from spreadsheets

Instead of updating employee pay rates one at a time, you can now upload a spreadsheet with all your pay rate changes and let Jemini process them automatically. This is particularly helpful during annual salary reviews or when you need to apply pay increases across multiple employees.

Upload your pay rate data as a CSV or Excel file through the Data Import section. Jemini will show you a preview of all changes and validate each record before importing. The system checks for common issues like invalid employee IDs, incorrect date ranges, or missing required fields, so you can fix problems before they affect your payroll.

For retroactive pay increases, you can specify back pay start dates and Jemini will automatically calculate when to process the back pay based on each employee's next available pay cycle. The import supports all pay rate types including annual salaries, hourly rates, rate codes, and pay levels.

You'll find the new "Import Pay Rates" option in the Data Import section if you have the appropriate permissions.

(JEM-22745)

Pay Rates Import includes backpay date fields for easier salary adjustments

When importing pay rates, you can include backpay start dates and backpay end dates in your import file. This makes it easier to process salary adjustments that need to be applied retroactively.

(JEM-23694)

Import Enhancements

You can now import transactions for employees with multiple employment streams using Occupancy UUIDs (Unique Identifiers)

When you're importing transactions for employees who have multiple employment streams, you can now use the Employment Occupancy UUID to target specific streams.

This means you can import pay transactions, leave events, and other data for any of an employee's employment streams, not just their primary one. If you try to import for a terminated employee, you'll now see a clear error message instead of just a warning.

(JEM-23378)

Leave Balance Import now supports Employment Occupancy for better data accuracy

The Leave Balance Import function now lets you specify Employment Occupancy details, just like other import functions. This gives you more control over which employment records receive the imported leave balance data.

(JEM-24087)

What else is new

Your Jemini Enhancements

Bank account messaging now matches your security permissions

When an employee visits Bank Accounts in Your Jemini with view-only access, they won't see the confusing message about pasting account numbers anymore. The "You can paste the full account number..." message now only appears when you actually have permission to add or change bank account details.

(JEM-24253)

Security Enhancements

Enhanced security for better system reliability

Jemini now runs with improved security measures that make the system more reliable and protect your data better.

(JEM-24705)

New software scans all file uploads for viruses

Enable the application setting called ‘Scan Uploaded Files For Viruses’ to turn on this scanning function.

(JEM-22468)

Tax Processing Enhancements

IRD payments now support 2026 tax year and beyond

You can now process IRD payments for future tax years, keeping your payroll compliant with IRD requirements.

(JEM-23406)

API updates

For developers and consultants managing APIs

We’ve added and updated REST APIs in these areas:

Bank Account

Employee Entitlement to Work

Employee Pay Rates (Back Pay functionality)

Employee Tax Details

Employee Superannuation

Payroll

Payroll Transaction Configurations

Payroll Transaction Applicabilities

Report Views (Performance improvements)

YTD Transaction Management

For detailed information on these changes, refer to the Swagger documentation, which is contained within the Jemini application. If you need access or have any questions regarding the APIs, please raise an iHelp.

(JEM-21806, JEM-22391, JEM-23351, JEM-23382, JEM-23405, JEM-23451, JEM-23587, JEM-23918, JEM-24144, JEM-24312, JEM-23820)

System Administration Enhancements

Better error reporting helps support teams fix issues faster

When system errors occur, Jemini now logs complete technical details instead of just basic error messages. This doesn't change how Jemini works for you, but it helps your IT support and system administrators diagnose and resolve problems more quickly when issues arise.

(JEM-23461)

Better debugging tools help support teams resolve system issues faster

Jemini now includes enhanced debugging utilities that help Jemini support and system administrators diagnose and fix system problems more effectively when issues arise in your environment.

(JEM-24098)

We've optimised database indexes to speed up system performance, especially for operations that were running slowly

You may notice faster loading times and more responsive navigation when working with your payroll data.

(JEM-23766)

(Reworded post-publication for clarity) We've added better tools for the Jemini support team to track and audit payroll transactions and calculations

Jemini support teams can now monitor payroll processing more effectively and spot calculation issues that need attention before it affects you.

(JEM-23664)

We've made development workflow improvements to help the Jemini team deploy updates more reliably

This includes fixing database script naming issues, upgrading GitHub Actions, and resolving workflow failures that were affecting system builds and deployments.

(JEM-23958, JEM-22669, JEM-23066)

We've improved the structure of tax-related code for better system maintainability

This behind-the-scenes improvement makes tax calculations more reliable and easier to maintain.

(JEM-23575)

(Reworded post-publication for clarity) New payroll auditing capabilities help Jemini support team detect and report data integrity issues during pay processing

Jemini now monitors payroll calculations at key processing points and creates alerts when data inconsistencies are detected. This includes monitoring during pay cycle processing, direct credit file generation, and IRD file generation. The system creates fault records when issues are found and provides configurable monitoring options for the Jemini support team.

(JEM-23747, JEM-23749, JEM-23750, JEM-23751, JEM-23821, JEM-23872, JEM-23924, JEM-24109, JEM-24121)

More reliable updates mean fewer disruptions

Behind-the-scenes improvements help prevent issues before they affect your work, so system updates are more stable.

(JEM-20137, JEM-19746, JEM-22939, JEM-23861, JEM-23047)

Better system maintenance keeps Jemini running smoothly

System maintenance and updates now work more reliably, reducing the chance of unexpected problems.

(JEM-22550, JEM-23187, JEM-22260, JEM-24031)

What’s Fixed

Fixes for issues raised by customers

Payroll Setup and Transaction Configuration

Fixed value amounts now display with four decimal places consistently in both transaction configuration and pay mode (JEM-24184)

New applicability records with different effective dates now save correctly without requiring name changes (JEM-24168)

Confirmation panels in Payroll Setup now appear only when you click 'Add Pay Period' instead of appearing prematurely (JEM-23659)

Creating Pay As You Earn (PAYE) transaction applicability records no longer times out when updating transaction configurations (JEM-23225)

Payroll Management and Calculations

Salary hours now calculate correctly when leave and public holidays occur in the same pay period (JEM-24097)

Annual leave hours display the correct amount without doubling (JEM-24056)

Fixed backpay with public holiday worked transactions where salary amounts would increase each time you switched pay periods in pay mode (JEM-24279)

PAYG Leave Payment transaction end dates now update when you change pay rate end dates, preventing overpayments (JEM-24285)

Annual leave payments now generate properly when employees are terminated (JEM-24276)

Leave payouts now work correctly when employees change from Permanent or Temporary employment status to Casual (JEM-24186)

Payslip comments appear when you override transaction amounts (JEM-24068)

Annual leave rate calculations now handle continuous leave scenarios correctly for employees returning from parental leave (JEM-23293)

WT tax codes now calculate PAYE at the correct 33% rate for Extra Pay transactions instead of incorrectly calculating at 10.5% (JEM-23994)

ESCT gross-up calculations now apply correctly for employees marked as 'Pay the ESCT on Behalf of the Employee', even when tax details change mid-pay period (JEM-23440)

Student loan deductions calculate correctly when tax details come through API data migration, applying the proper threshold amounts (JEM-21557)

When you change tax details from M SL to M, student loan transactions are removed (JEM-23660)

IRD employment information files include terminated employees with $0 net pay when they have earnings and deductions (JEM-22557)

Net Pay now displays correctly in Multiple Employment Pay Mode views. Previously, you couldn't scroll down to see Net Pay for secondary employment streams (JEM-23549)

Leave

When you update a leave plan, it now only affects relevant leave events, as expected. In one isolated case, Jemini mistakenly deleted an unrelated leave event (JEM-23181)

Date pickers in leave balance views now allow future date selection (JEM-24164)

The Leave Metrics Analysis and New Hire Diversity reports now let you filter by the year 2025, which was previously unavailable (JEM-22897)

Employee onboarding, actions, and lifecycle

Tax details panels now open correctly without system errors for employees with missing tax treatment codes (JEM-23403)

Leave request error messages in occupancy records now display properly (JEM-24085)

New Zealand employee terminations now correctly use NZ-specific termination reasons instead of the system incorrectly searching for Australian ones (JEM-24666)

In Upskilling, curricula no longer duplicate when scrolling through learning tasks at different zoom levels (JEM-24088)

You can now change employee commencement dates when no payroll processing has occurred. Previously, the system prevented commencement date changes even when no records were locked (JEM-23319)

Onboarding tasks now only show 'Add link' options when you've actually set that permission in the task configuration (JEM-22869)

Saving occupancy records with multiple organisation structures attached now works correctly on subsequent attempts (JEM-23923)

You can now enter a 0% tax rate for Tax Code STC when creating or updating Tax Details records – Jemini now shows a warning instead of an error (JEM-23245)

Profile bubbles now update correctly when you reverse an employee termination and change their commencement date (JEM-22925)

Rehired employees can now reuse their Tax File Number (TFN) or Inland Revenue Department (IRD) numbers within the same employment (JEM-23692)

Imports

Data imports now accept D-M-YYYY and YYYY-MM-DD date formats instead of rejecting them with format errors (JEM-23425)

You can now import pay transactions with 'Non Paid' calculation rules without getting incorrect validation errors about hourly pay rates (JEM-23634)

You can now import pay transactions for employees with multiple employments, even if one employment has been terminated and the employee rehired (JEM-22773)

Reporting

Customer Specific: Fixed Leave Metric Analysis report displaying blank boxes and errors, and set year to default to current year instead of previous year (JEM-23833)

Position Chart for Visio report no longer shows duplicate entries for employees with multiple organisation structures (JEM-24442)

Customer Specific: Leave Liability report now displays employee leave liability data correctly instead of showing error messages when trying to load the report (JEM-23993)

Application Programming Interface (API)

Customer-specific fix: Employee API requests using the ?expand=all parameter no longer throw "Unknown error" exceptions for employees without occupancy records (JEM-24443)

Customer-specific fix: Delete employee entitlement API now returns proper 400 errors with clear messages instead of generic 500 errors (JEM-24485)

API improvements now:

Prevent country-specific calculation rule errors

Return correct field values instead of null

Show employment status properly

Work with non-API created configurations

Provide specific error messages instead of generic system errors

Accept null date values correctly for ongoing transaction endpoints

Work properly with pay period dates without showing invalid date errors

Handle edge cases more gracefully instead of returning server errors when requesting employee information through the API with expanded details

(JEM-23980, JEM-23975, JEM-22663, JEM-24038, JEM-23967, JEM-23395, JEM-23268, JEM-24443)

Customer-specific fix: Employee deletion through the API now works properly when employees have upskilling records attached. This fixes an issue where API calls would fail with "Unknown error occurred" messages (JEM-23141)

Customer-specific fix: Fixed unhelpful error messages when requesting employee data through API integrations (JEM-24103)

System Administration

Database upgrades now complete successfully without errors when Australian payroll transaction configurations are present. We fixed missing transaction accumulator references that were causing upgrade failures (JEM-23471)

Customer-specific fix: Scheduled background jobs now show up in monitoring dashboards, allowing the affected customer to track when payroll runs, leave calculations, and other automated tasks complete. As part of this fix, we made a behind the scenes enhancement that makes it easier for the Jemini team to customise when Jemini cleans up old user access records. This means they can schedule these maintenance tasks during off-peak hours to avoid any impact on your daily payroll work, while making sure your employee access data stays properly managed (JEM-24569, JEM-24558)

Fixes for issues found during internal testing

Many of these issues were found in testing environments and were caught before reaching production.

Payroll Setup

Pay rate setup works correctly when payrolls have pay periods configured (JEM-23658)

Hours Worked entitlement is hidden from New Zealand payroll setup because this entitlement is for Australia only (JEM-23858)

Public holiday setup checks the correct country before blocking changes (JEM-22879)

Payroll Transaction Configuration

Adding transaction applicability records no longer creates unwanted end dates when you cancel the operation (JEM-23665)

Employer Super Transaction applicability creation no longer fails when system accumulators are missing (JEM-23995)

We've fixed how payroll accumulators link to transactions, which prevents mismatches between transaction totals and accumulator amounts (JEM-23306)

Database updates now include all necessary columns for the PayTransactionAccumulator table (JEM-23310)

Payroll Management and Calculations

Future pay cycles display correctly when payroll has an active date set in the future (JEM-23895)

Fixed ESCT calculations to use net salary (after pre-tax deductions) instead of gross salary for KiwiSaver contributions (JEM-24324)

Pay period information in Pay Cycles view now displays the correct selected period rather than defaulting to current (JEM-23289)

Leave payout calculations work correctly when employees move from permanent to casual status - both hours and payment amounts are now accurate (JEM-23871)

Average Daily Pay (ADP) days now calculates correctly when an employee's commencement date falls mid-pay period. ADP days previously showed as 0 for the first pay cycle (JEM-22587)

ADP days calculation now applies pro rata dates correctly when employees move between payroll frequencies (JEM-22584)

Pay cycle status displays 'Calculated with errors' when net pay records are end-dated. This helps you identify pay issues that need attention instead of only showing warnings (JEM-24030)

Future-dated payrolls show correct information in Payroll Management (JEM-23817)

Pay cycle status now updates properly after calculation when snapshot functionality is disabled. Previously, pay cycles would get stuck showing 'Calculating' status even after successful completion (JEM-24067)

Pay Mode

Pay Mode operations work reliably without unexpected errors. Fixed issues where creating transactions, navigating Pay Mode, accessing pay periods, and deleting tax details would fail

without clear error messages (JEM-23300, JEM-22918, JEM-23000, JEM-22802, JEM-22744)

New Zealand Pay Mode access stops logging Australian calculation errors (JEM-22412)

Leave

Fixed error when importing leave balances with dates before the employee's start date. The system now validates dates and shows clear error messages instead of crashing (JEM-24326)

Leave balance adjustment fields now properly display all decimal places when entering balance amounts instead of cutting them off (JEM-24390)

We fixed several leave balance and termination processing issues so imports work properly, you can open employee records after importing balances, leave reversals complete successfully, and employee termination saves correctly (JEM-23761, JEM-24082, JEM-24104, JEM-24127, JEM-24069, JEM-24008)

Leave balance imports handle days and hours correctly, and balance records properly ignore earlier dated events (JEM-11499)

The system now stops leave requests that would go below minimum balance requirements, even when employees have multiple future leaves booked (JEM-24259)

Leave balance adjustment functionality has been retested and confirmed working correctly (JEM-23458)

Leave Balance Adjustment opens for employees without leave plans (JEM-24090)

Deleting work patterns on the second day of leave events works without errors (JEM-23857)

Leave balance recalculations now properly update all future stored balance periods when you import leave balances or process retrospective leave events. Previously, some future balance periods weren't being recalculated, which could show incorrect leave balances for employees (JEM-24229)

Leave reversal requests now process correctly without showing incorrect error messages about work pattern hours (JEM-24141)

You can now add new leave reversal requests after deleting previous ones without getting transaction rollback errors (JEM-24143)

The ‘View Leave Balance Adjustments’ option now works properly for employees who don't have any leave plans attached. Previously this would show an error message (JEM-24091)

Employee Onboarding and Actions

If you decide to add a new employee halfway through editing another employee's record, like an Occupancy record, the Add Employee panel will open as expected (JEM-22589)

Employment Basis dropdown in employee tax details now validates correctly when an option is already selected (JEM-22629)

Tax category field in employee tax details now displays proper validation messages rather than showing 'null' (JEM-22928)

Employee bubbles show proper text instead of "Add Icon". Tax details and superfund bubbles now display 'No current tax details' and 'No current Superfund' when no data exists (JEM-23298)

Delete Superfund records without crashes (JEM-22642)

We've improved how employee attachments are shared across Bank Account, KiwiSaver, and NZ Tax Details records to reduce unnecessary file duplication (JEM-22120, JEM-22121, JEM-22119)

Occupancy

Organisation Structure page now loads properly instead of showing 'Page not found' errors (JEM-22923)

Terminations

Employee termination reversal from the Multiple Employment page completes successfully (JEM-23124)

Termination error messages appear correctly instead of showing "null" (JEM-23429)

Termination reversal works for employees with multiple employment streams (JEM-23642)

Locations

The back button on the Locations page now works correctly. This fixes an issue where browser security policies were preventing proper navigation (JEM-24283)

Login

When you're logged in as an employee in New Zealand, you won't see the 'Property not found' error message anymore (JEM-23686)

We resolved employee login and profile access issues for both profile bubbles and general employee access (JEM-22916)

Imports

Pay rate imports with PAYG amounts no longer get stuck loading (JEM-23426)

Import Pay Transactions Target Date field shows accurate help text (JEM-22693)

Application Programming Interface (API)

Employee API responses return complete field data instead of null values (JEM-22645)

Bank account API calls now return proper employment occupancy information instead of null values (JEM-23878)

When rehired employees need leave balance imports or API updates, the system now uses Employment Occupancy UUID to find the right employment record (JEM-24113)