Use Pay Rate Import to add or update employee pay rates in bulk

The pay rate import option is useful when you're setting up pay rates during implementation, processing annual pay reviews, applying bulk pay increases including backpay, or migrating pay rate data from another system.

Before you begin

Make sure you have:

Employees set up in Jemini with their employment records

Pay rate types defined in Jemini (annual salary, hourly rate, daily rate)

Knowledge of effective dates for the pay rate changes

Import permissions enabled in your security profile

If you're unsure about pay rate types, ask your Jemini support consultant.

Preparing your pay rate file

Ask your Jemini support consultant for the pay rate CSV template.

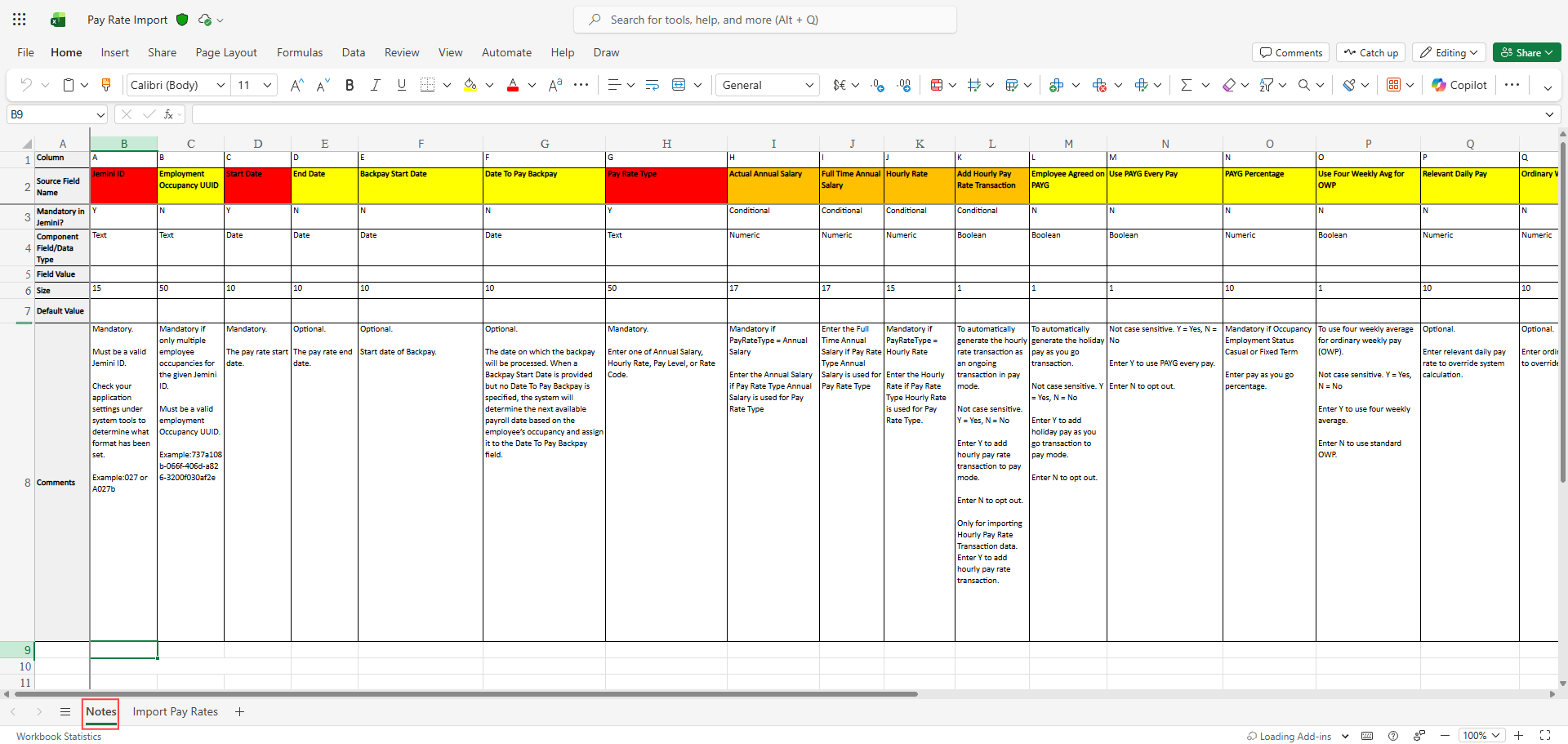

The template looks like this:

.png)

NOTE: This screenshot shows the general look of the template but might not be the latest version.

The template has notes in a second tab. Use this tab to check the rules and recommendations for each field.

NOTE: This screenshot shows the general look of the template but might not be the latest version.

Required vs optional fields

Required fields

Every row must include:

Jemini ID: The employee number (For example, EMP001). If the employee has multiple employments, you'll also need the Employment Occupancy UUID.

Pay Rate Type: The type of pay rate (for example, Annual Salary, Hourly Rate, Daily Rate).

Start Date: The date the pay rate becomes effective. Use formats like dd/MM/yyyy or yyyy-MM-dd.

Rate Amount: The pay rate value (For example, 75000.00 for annual salary or 35.50 for hourly rate).

Optional and conditional fields

The template will indicate which of the remaining fields are optional or mandatory, depending on the pay rate type and your region.

Leave fields blank if they don't apply to your pay rate.

To learn more, refer to Preparing your CSV file.

TIP

Using pay rate import for backpay

If you need to backdate a pay rate and process backpay, the import includes optional backpay fields.

Backpay fields:

Back Pay Start Date: The date from which the backpay calculation should start

Date To Pay Back Pay: The date when the backpay should be processed (typically the next pay run)

For more on backpay, refer to Intro to Backpay.

Save the file in CSV format

When you’re ready to save the file, make sure the correct tab is open in Excel.

In Excel, go to File > Save a Copy.

Select CSV (Comma delimited) (*csv) from the file type dropdown list.

Select Save.

A message will appear about not supporting workbooks with multiple sheets. Select OK to save only the active sheet.

Now you’re ready to import your data into Jemini.

How to import your data

Uploading your file

Go to System > Import.

Select the Pay Rates card.

Set the CONTAINS HEADER ROW toggle to Yes or No.

Set it to Yes if you’ve used the template – your file has a header row.

Set to No if your file doesn’t have a header row.

Drag and drop your files into the box on screen or use the Select a file from your computer button and find your prepared CSV file.

When dragging and dropping, make sure the box border turns light blue before you drop the file.

Jemini will process your file and show you a preview.

Reviewing the preview

The preview shows each row from your file with validation results.

Check for errors: Red indicators show errors that you must fix before importing.

Check for warnings: Orange indicators show potential issues that don't prevent the import.

You can filter the preview to show all records, errors only, or warnings only.

If you see errors, cancel the import by selecting the red X button, fix the issues in your original file, and upload again.

If you see warnings, either cancel the import and upload your updated file, or acknowledge the warnings.

For more on import errors and warnings, refer to Checking your data before it imports.

Completing the import

Once you're happy with the preview:

Select the Green Tick Button to continue to confirmation.

Select Go ahead.

Jemini processes the records in the background. When complete, you'll see a success message.

Verifying your import

After importing:

Go to the employee's Occupancy record to check the pay rates appear correctly.

Review the effective dates to confirm they're accurate.

Check that the pay rate amounts are correct.

Test a pay calculation for affected employees to ensure the rate applies correctly.

Troubleshooting common errors and warnings

Error: Employee not found

Check the Jemini ID matches exactly (including any leading zeros)

If the employee has multiple employments, add the Employment Occupancy UUID

Error: Invalid pay rate type

Verify the pay rate type matches one of the valid types in your system

Check spelling and capitalisation match exactly

Error: Invalid date format

Check your dates match one of the accepted formats (dd/MM/yyyy or yyyy-MM-dd)

Make sure dates are valid (no 31/02/2025)

Error: Overlapping pay rate periods

Check if the employee already has a pay rate that overlaps with the dates you're importing

You may need to end-date the existing pay rate before importing the new one

Warning: Future-dated pay rate

This means the pay rate has a start date in the future

You can proceed if this is intentional (for scheduled pay increases)

For further help, contact your Jemini support consultant.