Navigation: People | Employees | ‘Select the Employee you need to manage’ | Action | Tax Details

The Tax Details bubble holds the tax information for each employee. For example, tax details include an employee's IRD number, tax code, and ESCT rate.

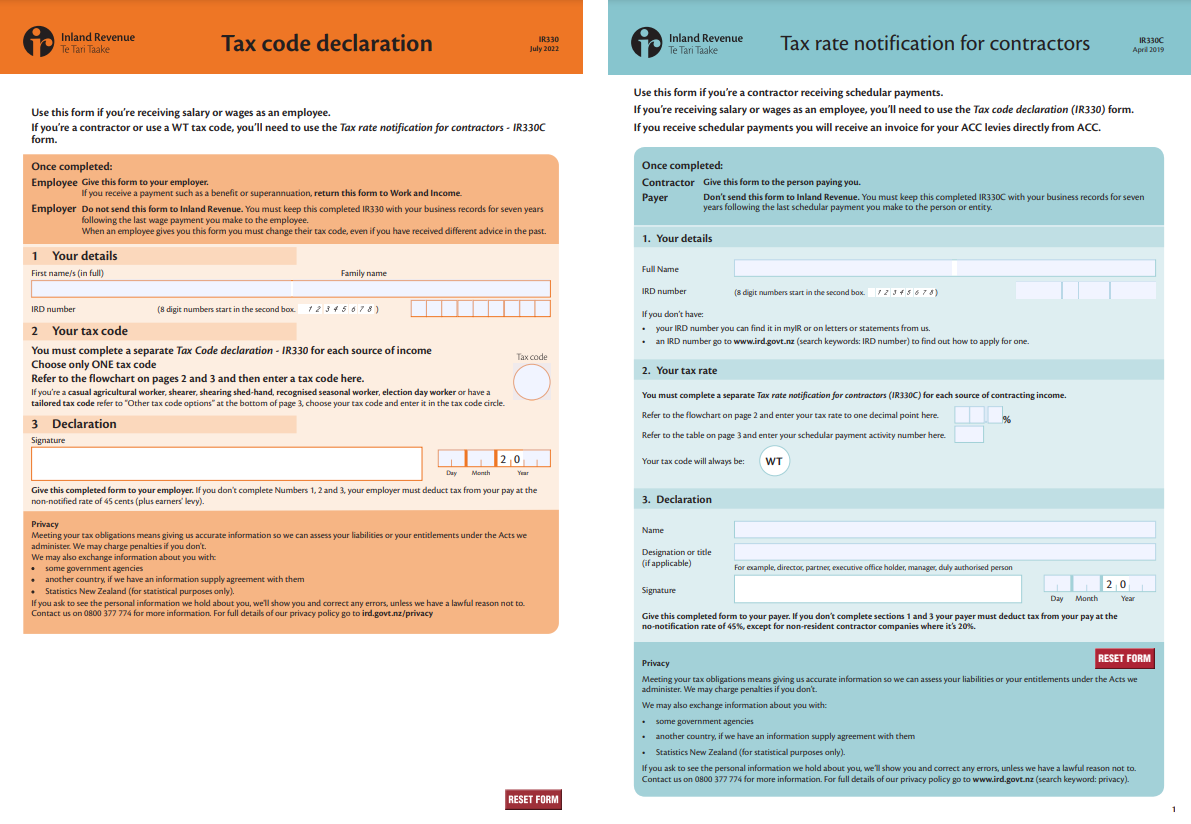

When the employee is hired, you would typically get them to fill out a tax code declaration form from the IRD. These could be, for example, a IR330 - Tax code declaration or a IR330C - Contractor Tax code declaration.

Use the Tax Details bubble to enter the tax information provided by the employee.

How to add a tax detail record

- Go to People | Employees.

- Select the employee you need to add tax details to.

- Go to Action | Tax Details. The dated TAX DETAIL panel will open.

- Select Add a tax detail record. The ADD TAX DETAIL panel will open.

The START DATE will have been added automatically and will match the employee's occupancy start date.

- Enter the END DATE if required.

- Select a tax option from the TYPE OF TAX UPDATE drop-down list.

- Enter the employee's IRD NUMBER. The IRD number can be found on the IR330 form completed by the employee.

- Select the employee's TAX CODE from the drop-down list. The tax code can be found on the IR330 form completed by the employee.

- If the employee is a casual employee, you'll need to enter the ESTIMATED NUMBER OF HOURS THIS TAX YEAR FOR ESCT.

- If the employee has a student loan (that is, using a tax code ending with SL), you'll need to enter the STUDENT LOAN REPAYMENT RATE.

- Additionally, if the student has a student loan, you may need to enter the SLCIR and SLBOR details.

SLCIR and SLBOR are extra student loan deductions.

- SLCIR is a compulsory deduction specified by the IRD.

- SLBOR is a voluntary deduction requested by the employee.

- Enter the DATE SIGNED. For example, the date the IR330 form was signed by the employee.

- Select the ESCT RATE from the list or select Use ESCT rate determined by system.

To determine the ESCT rate for the tax year correctly, we need the Pay Rate, the KiwiSaver and all Super records to be created first.

- Select the TAX RATE % FOR EXTRA PAY from the list.

- Enter the ACC LEVY RATE FOR BIC CODE OF EMPLOYEE.

- In the Content section, enter COMMENTS, ATTACH DOCUMENT (for example, the employee's IR330 form), and add LINKS if required.

- Select the Submit icon to save and close the ADD TAX DETAIL panel. You'll see the new Tax Details record added to the CURRENT section of the dated TAX DETAIL panel.

- You may now close the dated TAX DETAIL panel.

Types of tax updates

IR330 - Tax code declaration form

Select this option when the employee has completed a IR330 - Tax code declaration form.

Follow the above How to add a tax detail record steps. At step 7, select IR330 - Tax code declaration from the TYPE OF TAX UPDATE drop-down list.

Enter the details from the form completed by your employee.

No IR330 provided

If the employee hasn't completed an IR330 form, select the No IR330 provided option, which will automatically apply the ND (non-declaration) tax code.

Follow the above How to add a tax detail record steps. At step 7, select No IR330 provided from the TYPE OF TAX UPDATE drop-down list.

When you select No IR330 provided, the IRD NUMBER and TAX CODE fields will go grey, and the ND (non-declaration) code will be selected automatically.

You can't edit the IRD NUMBER or TAX CODE fields when the No IR330 provided type of tax update is selected.

IR330C - Contractor Tax code declaration form

Select this option when the employee has completed a IR330C - Contractor Tax code declaration form.

Follow the above How to add a tax detail record steps. At step 7, select IR330C - Contractor Tax code declaration form from the TYPE OF TAX UPDATE drop-down list.

Enter the details from the form completed by your employee.

ESCT update

On 31 March each year, Jemini will run a script to calculate the ESCT rates for the year and automatically create a new tax record if the ESCT rate that we determine now is not equal to the ESCT rate that the employee has on the current tax record.

ESCT updated is a tax update that will be used for those records.

Follow the above How to add a tax detail record steps. At step 7, select ESCT update from the TYPE OF TAX UPDATE drop-down list.

Custom

Use the Custom option for any updates that don’t match the criteria in the other tax options.

Follow the above How to add a tax detail record steps. At step 7, select Custom from the TYPE OF TAX UPDATE drop-down list.