Who can benefit from this guide?

Payroll staff who are responsible for managing Australian payroll information.

Jemini uses STP to report ATO payroll information

If you manage the payroll for an Australian business, you know the importance of reporting payroll information to the Australian Tax Office (ATO) with each pay run. Jemini makes this process simple by incorporating the government’s Single Touch Payroll (STP) Phase 2 initiative. With Jemini, you can generate and submit ATO payroll files during pay processing, and Jemini will send these files directly to the ATO for you.

ATO payroll file generation and submission process

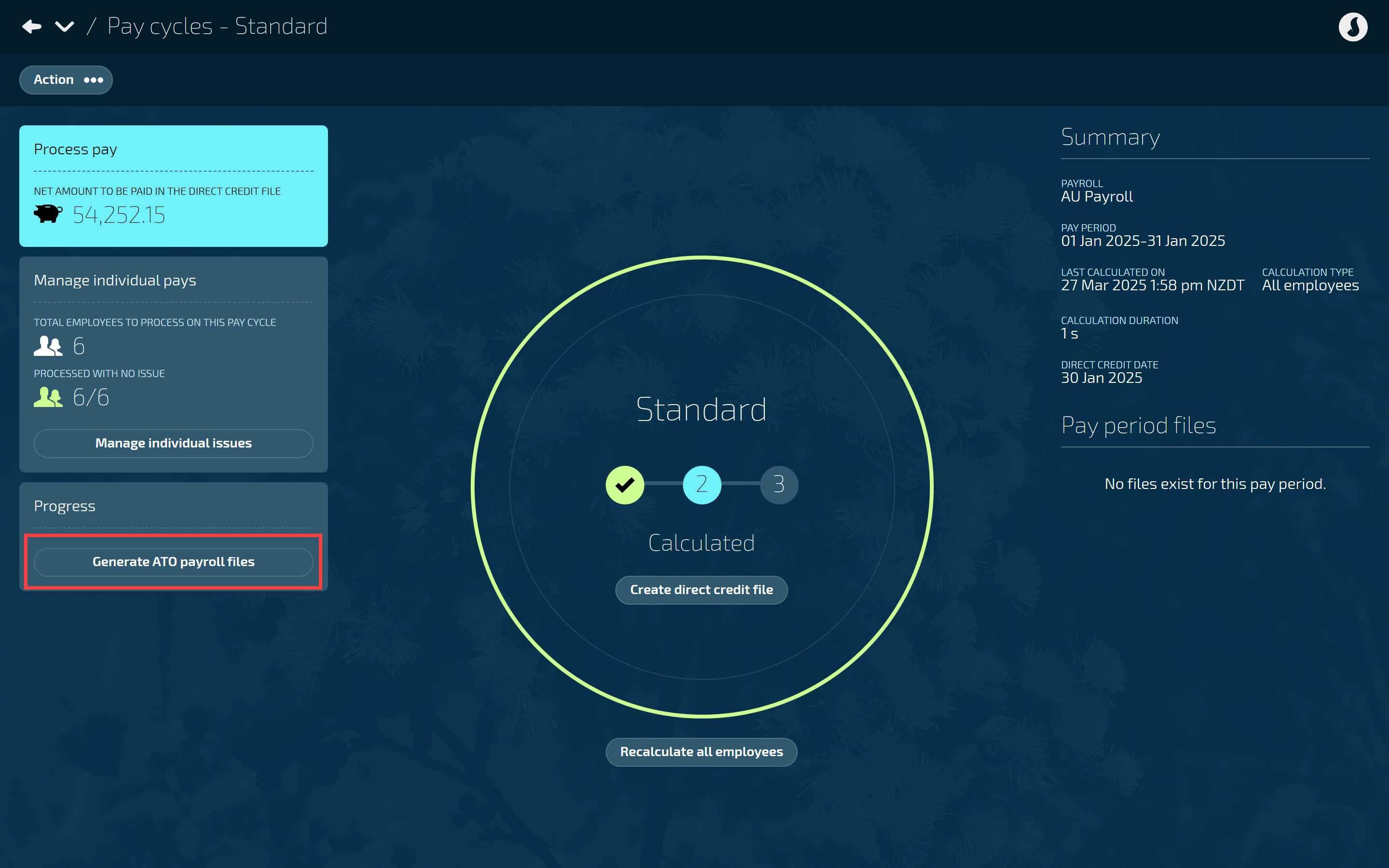

After calculating pay in a pay cycle, you’ll be able to generate an ATO payroll file. Start this process by selecting the Generate ATO payroll files button.

How to generate and submit an ATO payroll file

Go to PAY > PAYROLL MANAGEMENT.

Follow the process for running a pay outlined in Intro to Pay Cycles (Australia only), up until the employees are calculated or a direct credit file has been created.

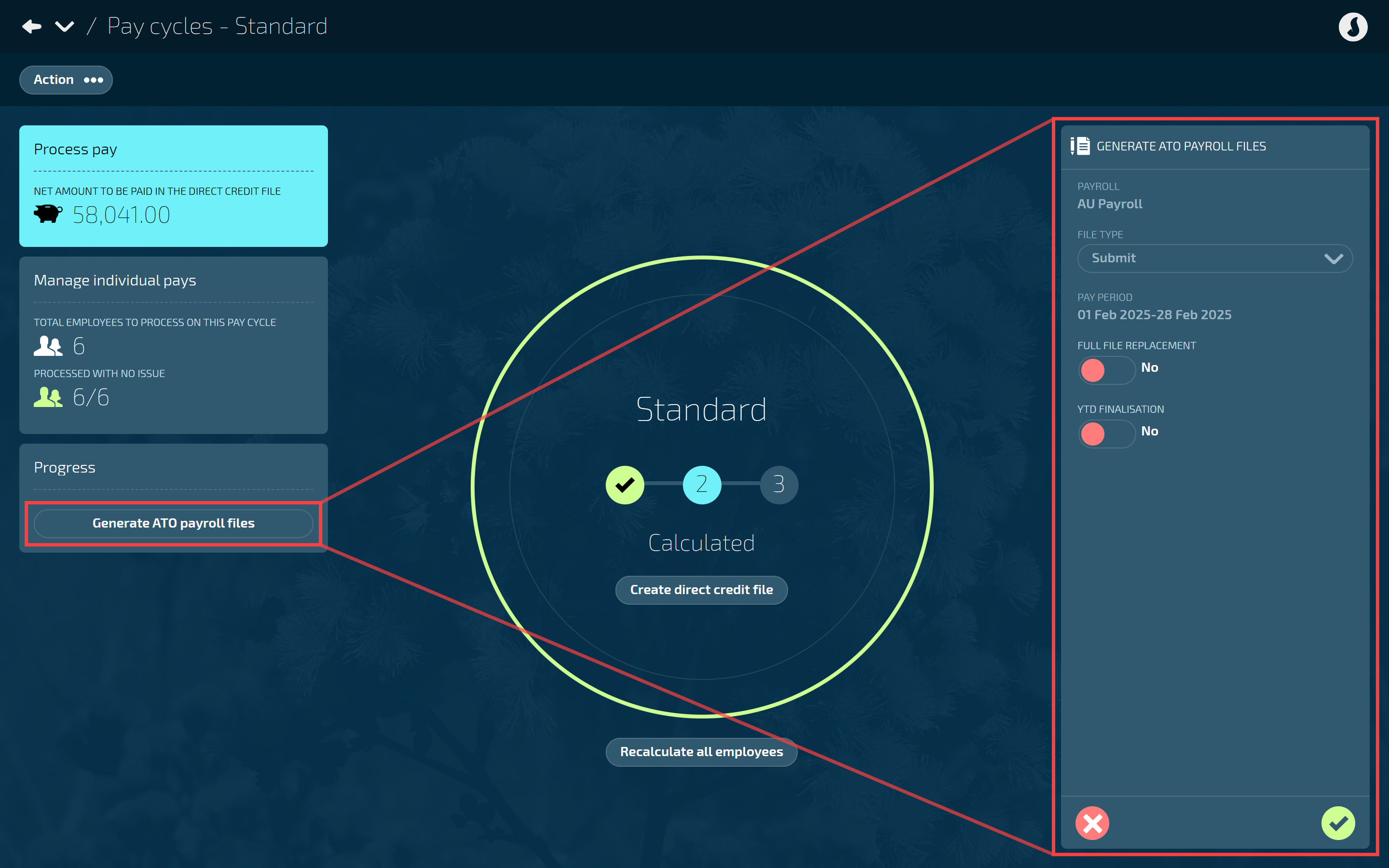

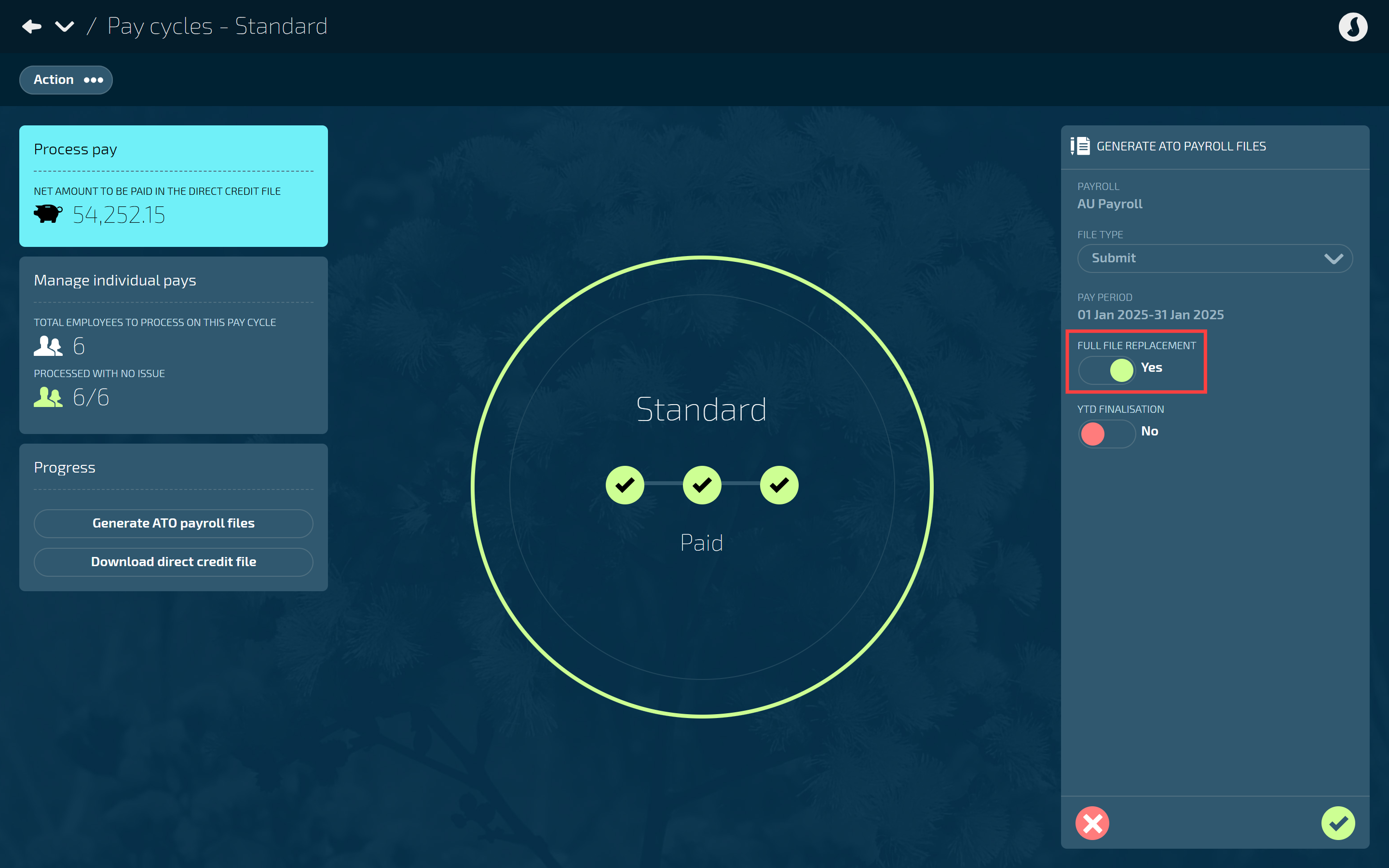

In the Progress section, select Generate ATO payroll files to open the GENERATE ATO PAYROLL FILES panel.

FILE TYPE and PAY PERIOD will be read only. They will indicate that the submit file will be generated for those dates.

Set FULL FILE REPLACEMENT to Yes or No.

Defaults to No. Use this if it’s your first submission.

Set to Yes if you’d previously submitted the file and it came back with issues.

Refer to Full file replacements section below.

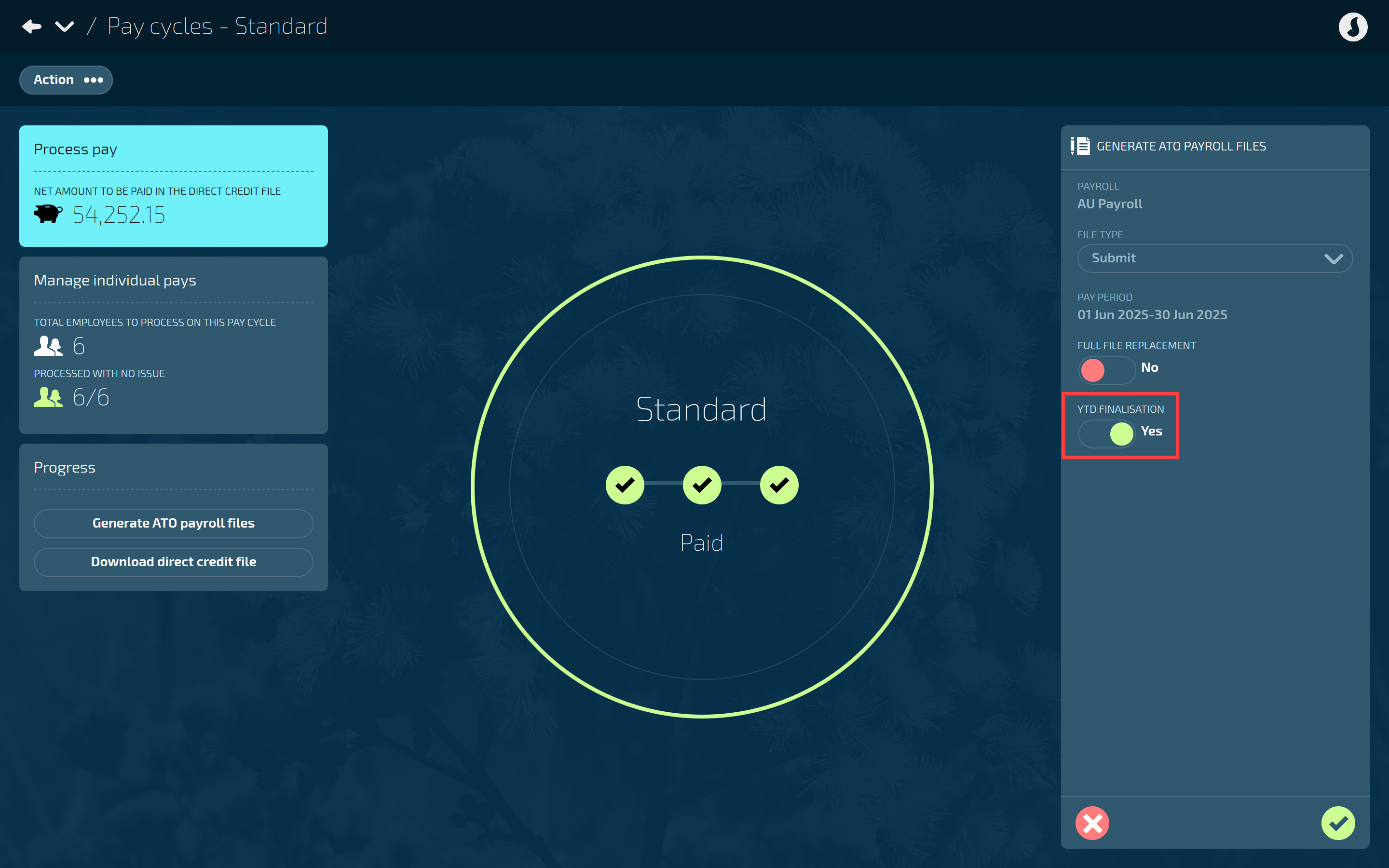

Set YTD FINALISATION? to Yes or No.

Defaults to No. Use this if it’s not your final pay period processing for the year.

Set to Yes if this is your final pay period processing for the year (end of June).

Refer to Declaring an ATO file as the YTD finalisation section below.

Select the Green Tick Button to generate the files.

Review the Files generated display message.

The message contains:

File type (Submit)

Payroll (the payroll it was generated for)

Pay period (the pay period it was generated for)

Tags - These identify what actions you’ve taken:

None (Regular submission)

Full file replacement

YTD Finalisation

Issues (Any issues that occurred during file generation will be displayed here).

TIP

If there are issues that need fixing, you may need to regenerate the file. After addressing the issues, you can select the Regenerate file button available in the Pay period files section.

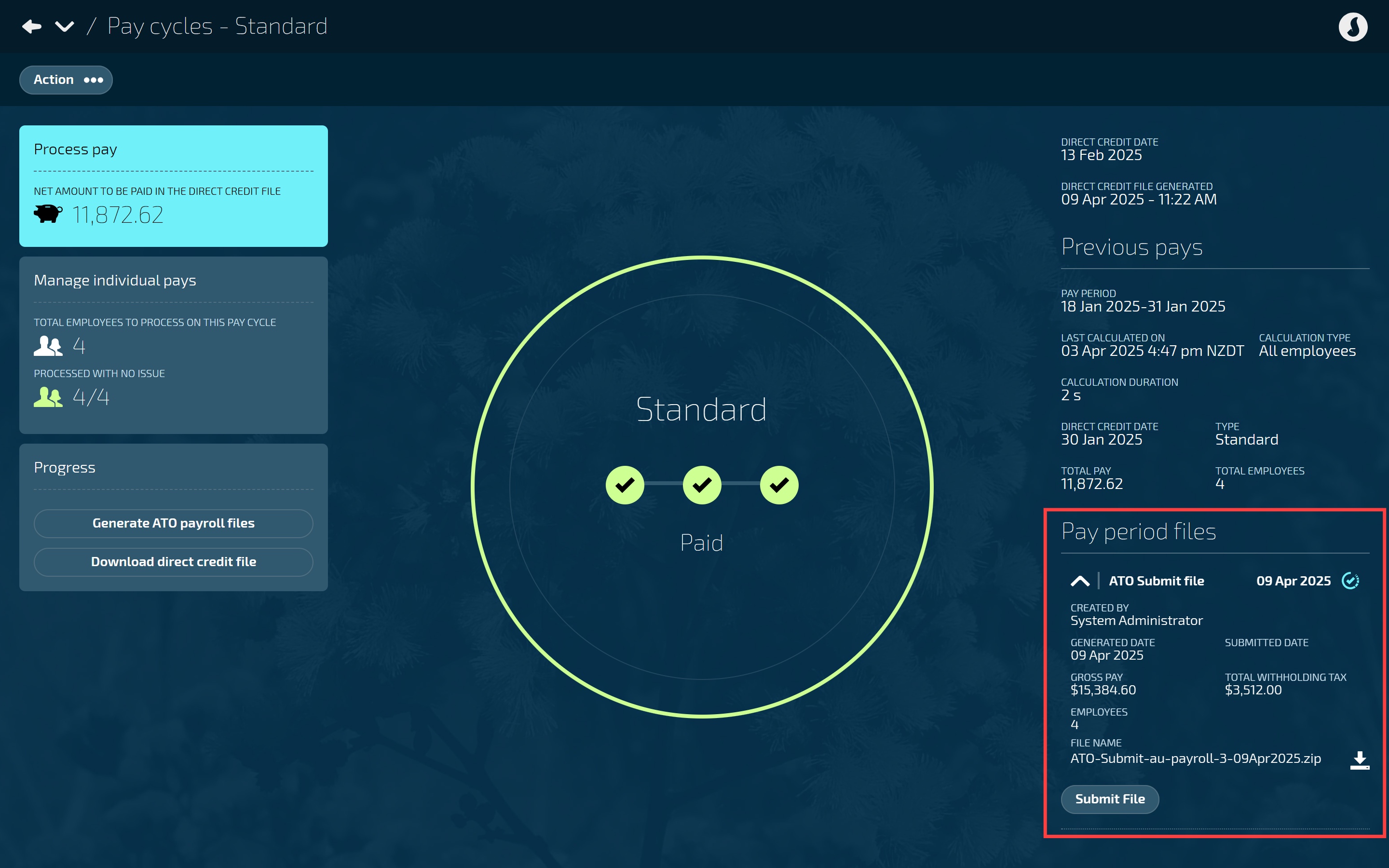

Choose to Submit now or Submit later (or Fix issues):

If you’re ready to proceed, select Submit now and move on to the next step.

If you’re not ready to proceed, select Submit later. When the panel closes, a Submit file button becomes available in the Pay period files section for you to submit the generated file.

If there are issues, Jemini will show an error or warning icon and create a downloadable CSV file with specific details. Download the CSV file to see what needs to be fixed, address the underlying data issues, then generate a new ATO Submit file.

Read and accept the Acknowledge & Submit message,

Select Go back if you’ve changed your mind.

When you submit the file, Jemini will send it to the ATO and you’ll be taken back to the Payroll Cycles view. Follow the file’s progress in the Payroll files section.

Pay period files contain the ATO Submit files you’ve generated for that period

To learn more about the pay period files section, refer to Pay period file indicators and messaging.

Monitoring your STP submissions with PowerBI reports

After you've submitted ATO payroll files, you can track their progress and check for any validation issues using these reports:

STP Progress

STP Submission Validation

To access these reports, go to Pay > Reporting. You'll need the appropriate permissions to view them. Once open, you can filter the data, drill down into specific pay periods, and export the information if needed.

Updating an ATO payroll file

To learn how to update an ATO payroll file, refer to How to update ATO payroll files.

Full file replacements

When to use the full file replacement option

Use the full file replacement to completely replace the latest STP file submitted successfully to the ATO.

This is necessary when your original submission contains errors or corrupt data.

It allows you to correct significant issues in the payroll data by replacing the file that was initially generated and still use the same file IDs.

When NOT to use the full file replacement option:

Minor corrections. Instead, submit an ATO Update file.

When an ATO update file has already been submitted for the original file. Full file replacements can only replace the most recent successful ATO Submit file.

Declaring an ATO file as the YTD finalisation

Use the Year to Date (YTD) finalisation option when submitting or updating an ATO payroll file when you need to declare that you’ve provided all the information for each employee for the financial year. This involves setting the YTD FINALISATION toggle to ‘Yes’ in the GENERATE ATO PAYROLL FILES panel when submitting or updating a file.

The file flagged as YTD finalisation must be completed before 14 July each year and should include all employees paid in the current YTD for the payroll. While this can be done as part of the last payroll submit event, you may prefer to perform a reconciliation before sending the flag through an update event.