Who can benefit from this guide?

Payroll staff who are responsible for managing Australian payroll information.

Generate and download a SAFFE file while running a pay cycle

SAFFE stands for SuperStream Alternative File Format Extended. It's the file format you use to send employee contribution data to superannuation funds (super funds) in Australia using the SuperStream standard. Jemini generates SAFFE files in the correct format while you're running your pay cycle.

Until 2026, you need to send SAFFE files to a clearing house every quarter for super payment distribution. But you can also send them with each pay cycle when you pay your employees. From 2026, payday lodgement becomes mandatory. When you send the file on the same day as the payment, the clearing house can match the super fund information and payments more easily, so contributions go to the right employee accounts. Generating your SAFFE file during the pay cycle makes the whole process simpler.

SAFFE file generation process

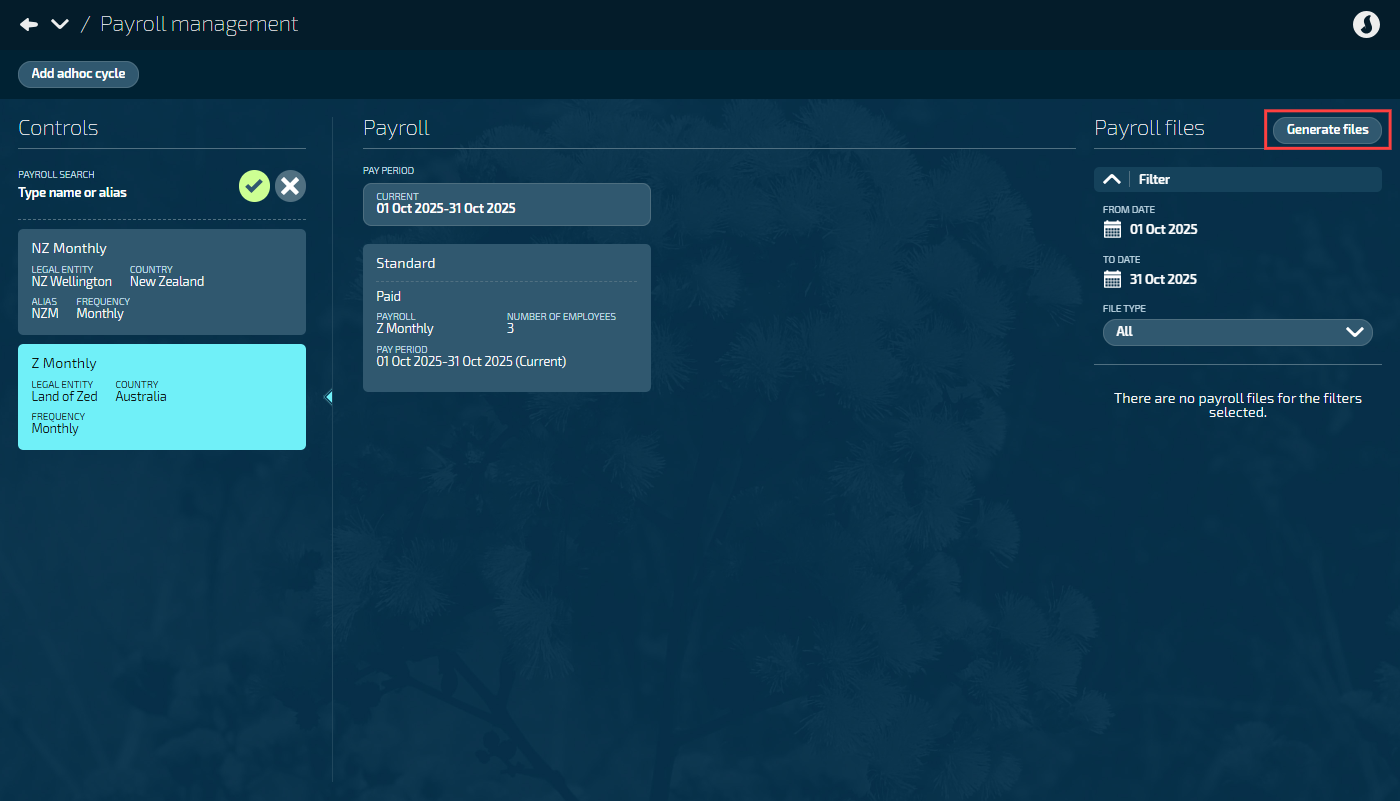

You can generate SAFFE files in Payroll Management by selecting Generate files.

TIP

You need at least one pay cycle with Paid status before you can create a SAFFE file. Jemini uses the payment information from completed pay cycles to populate the file.

When you generate a SAFFE file, you'll need to:

Choose how to select payments:

Pay cycle: Select a specific pay cycle

Date range: Pick a date range (Jemini will include all paid pay cycles within those dates)

Select your file format (CSV or TXT)

How to generate a SAFFE file

Go to PAY > PAYROLL MANAGEMENT.

Choose the relevant payroll from the list under Controls.

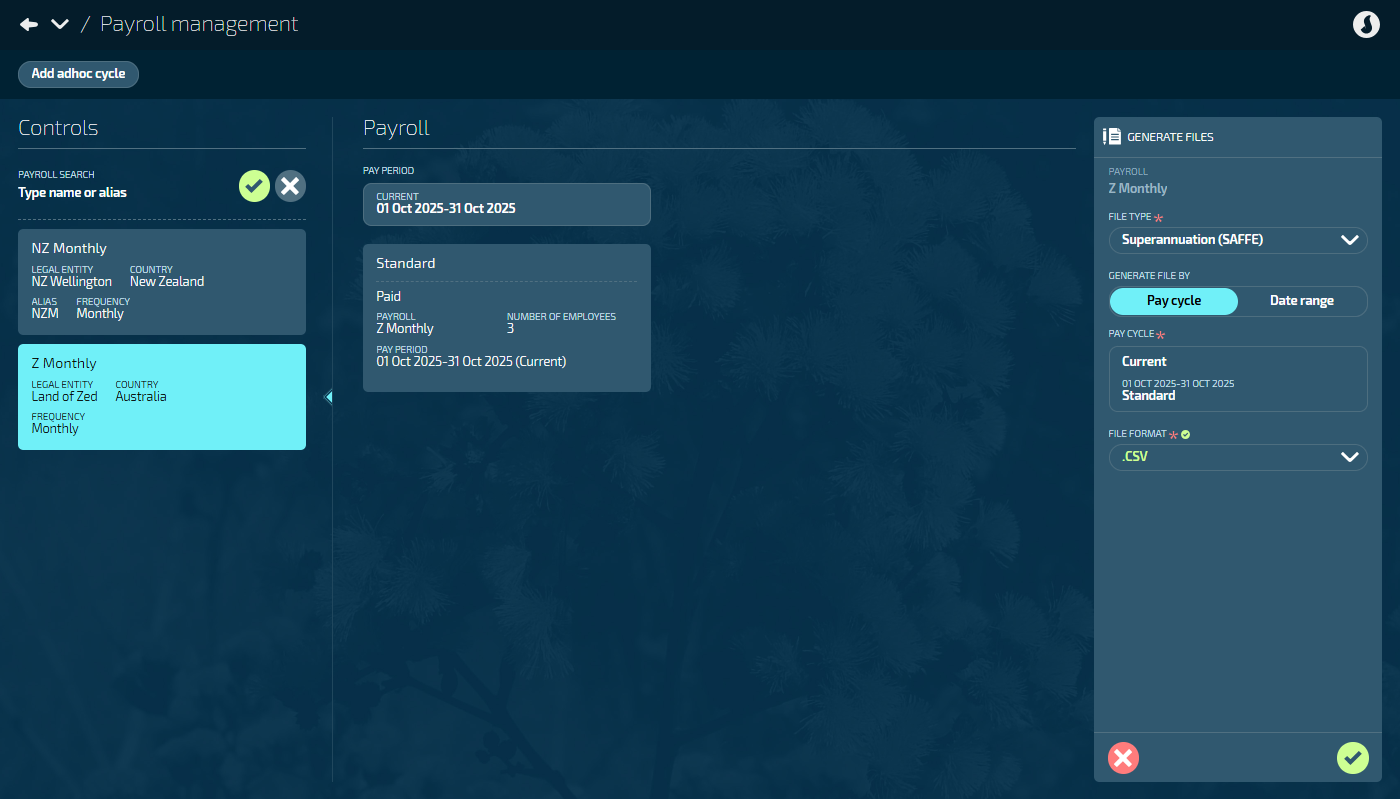

In the Payroll files section, select Generate files to open the GENERATE FILES panel.

Select Superannuation (SAFFE) as the FILE TYPE.

Select Pay cycle or Date range to GENERATE THE FILE BY.

If you choose Pay cycle, the current pay cycle will be selected by default. You can choose another pay cycle from the PAY CYCLE backpack if needed. Jemini will generate the SAFFE file using the pay period for that pay cycle.

If you choose Date range, enter the from and to dates or use the date picker to SELECT DATE RANGE. The date range option is useful for generating quarterly SAFFE files.

Select the FILE FORMAT.

Options are:

CSV

TXT

Select the Green Tick Button to generate the files.

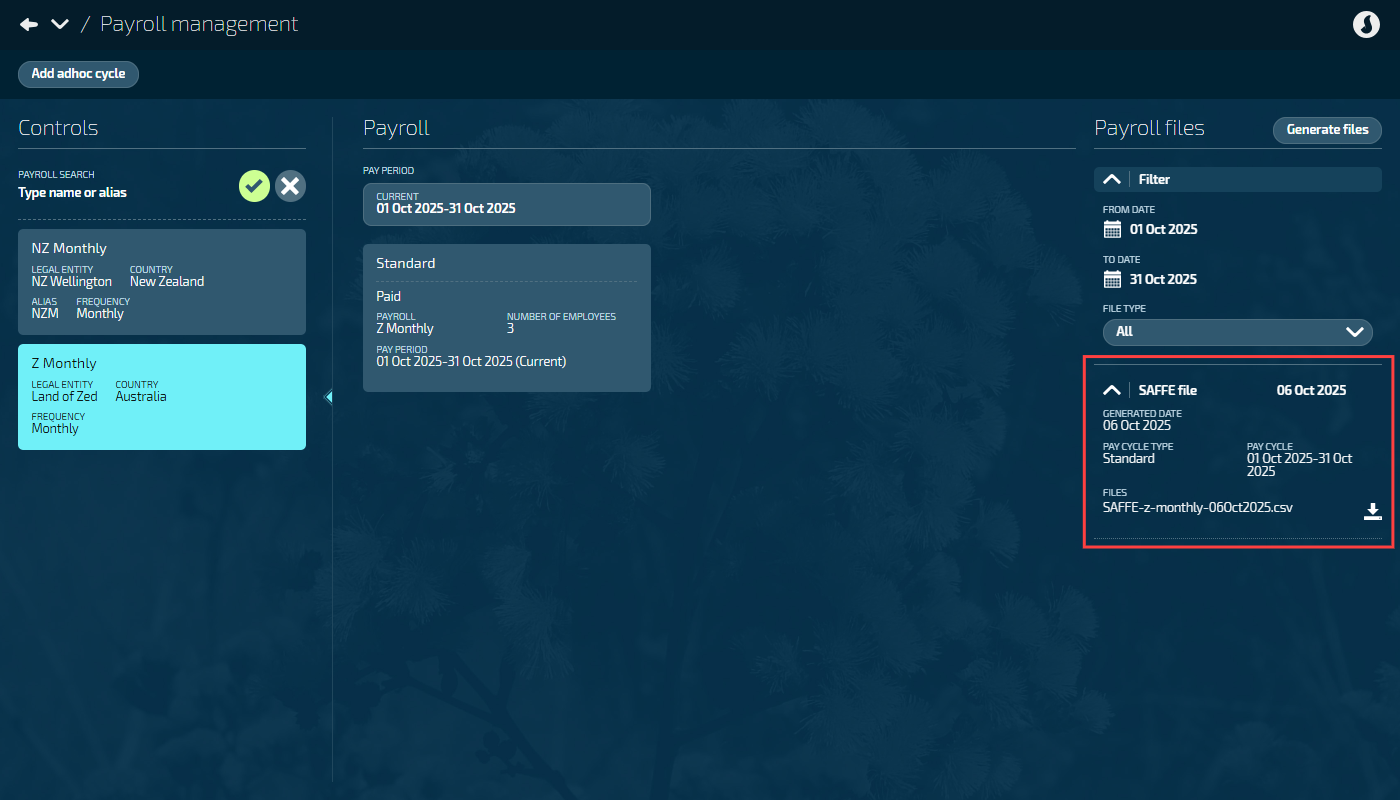

Review the Files generated display message.

The message contains:

File type (SAFFE)

Payroll (the payroll it was generated for)

Pay cycle (the pay cycle it was generated for)

Pay cycle type (Standard or Adhoc)

File format (CSV or TXT)

Generation date (today’s date)

The downloadable file

Select the file to download it now or select the I got it button to close the panel and download the file from the Payroll files section in Payroll Management later.

TIP

If Jemini finds errors during file generation, you'll see two files available for download: your SAFFE file and a separate errors file (ending in "-GenErrors.csv" or "-GenErrors.txt"). Download the errors file to see what needs fixing, make the necessary corrections in your employee or payroll data, then generate a new SAFFE file.

Once you’ve downloaded the SAFFE file, you can send it to a clearing house (or upload to the clearing house portal) for superannuation payment distribution.

TIP

To learn more about the payroll files section, refer to Pay period file indicators and messaging.