Who can benefit from this guide?

Payroll staff who are responsible for entering and managing payroll information for Australian or New Zealand employees.

What's Backpay?

Backpay (or back pay) is money that an employer owes to an employee for work that was performed in the past but wasn't paid at the correct or agreed-upon rate or within the agreed-upon timeframe. It typically occurs when there's been an underpayment or delay in payment of wages or salary owed to an employee. Backpay is provided to rectify the situation and make sure that the employee receives the correct compensation for their past work.

For example, if an employee's new pay rate should have kicked in from 25 March, and it's now 20 October, there are missed pay periods when the employee should have been paid the higher rate. Any incorrect payment made from 25 March will need backpay applied to cover the difference.

How does Backpay work in Jemini?

When you update a pay rate record with a start date before the latest processed pay cycle, Jemini will recognise that the employee might be owed backpay. New settings will appear to allow you to set the backpay dates. Depending on the dates you enter, the employee will be paid with the next regular pay cycle or through an ad hoc pay cycle.

You can review the backpay transactions in Pay Mode. The Salary Rate (or Hourly Rate) and Leave will have a separate backpay transaction line. Backpay that's calculated for all other transactions, such as KiwiSaver and ESCT, will be a combined value.

How to add Backpay

Open the employee's Pay Rate:

Go to People > Employees.

Select the employee you need to edit.

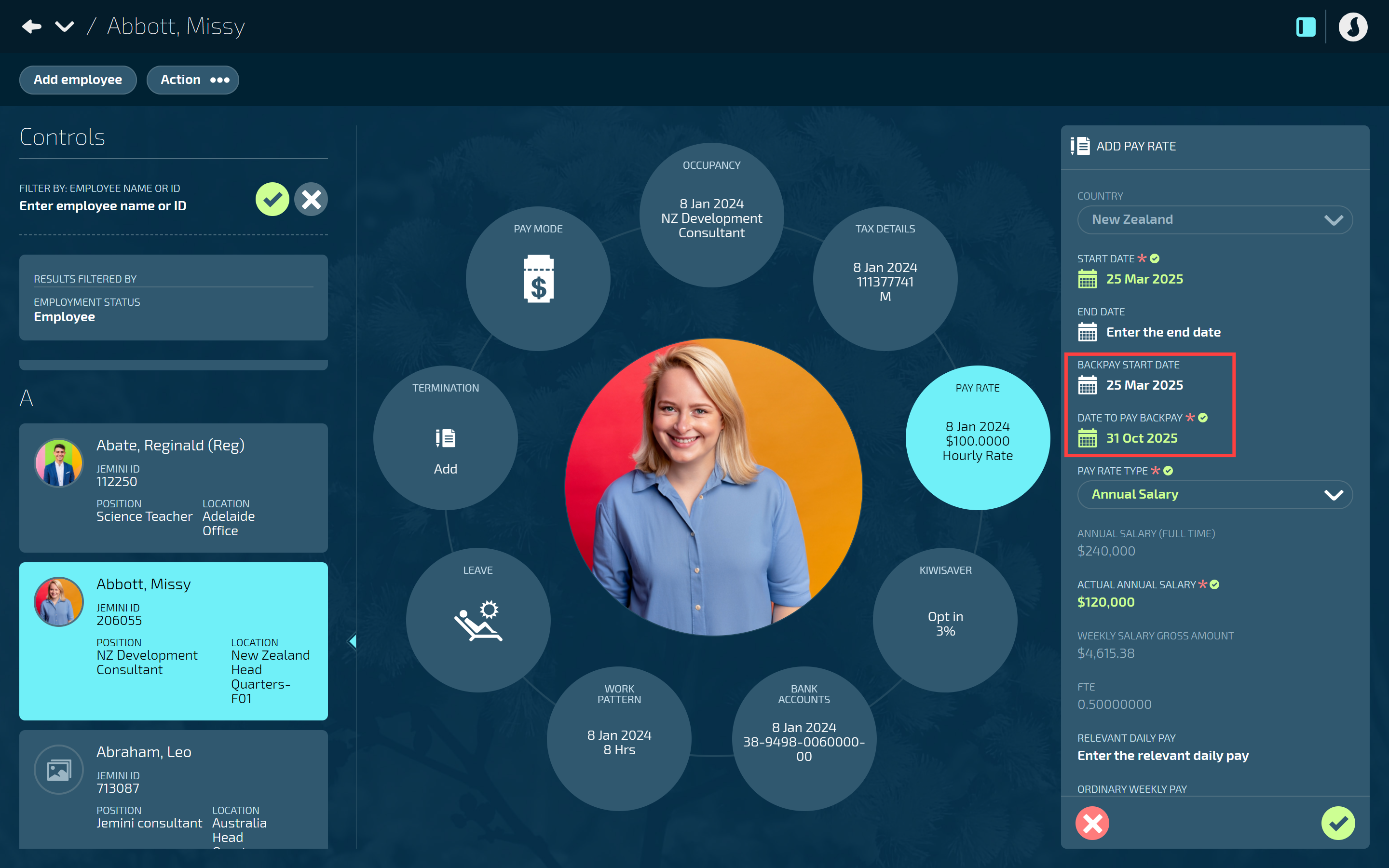

Go to Action > Pay Rate. The dated PAY RATE panel will open.

The current pay rate (and any forecast or historical pay rates) will be visible.

Select Update pay rate record to open the ADD PAY RATE panel.

Enter the START DATE for when the employee should have started receiving their new pay rate.

If you intend to backpay the employee, enter a date that's before the most recently processed pay cycle and matches the date when the new pay rate was supposed to have started.

The BACKPAY START DATE and DATE TO PAY BACKPAY settings will appear.

The BACKPAY START DATE will match the START DATE by default. If you delete the BACKPAY START DATE, the system won't register that the updated pay rate needs to be back paid.

The DATE TO PAY BACKPAY will match the next pay cycle date by default. If you want to pay the employee's backpay outside of a regular pay cycle, you can enter a different date, which will generate an ad hoc pay cycle.

For the PAY RATE TYPE, choose Annual Salary or Hourly Rate.

Enter the ACTUAL ANNUAL SALARY or HOURLY RATE, depending on the chosen PAY RATE TYPE.

The amount you enter here should match the full annual salary or hourly rate that the employee should be receiving.

Complete other settings in the panel as required.

Select the Green Tick Button to save and close the panel.

What happens once the Pay Rate is updated?

When you've updated the pay rate, the backpay will be calculated in the next Pay Cycle. You can then review the backpay transactions in the employee's Pay Mode.

You can quickly check the calculation status of the backpay in the Pay Mode header once you've opened the appropriate pay period.

The Salary Rate (or Hourly Rate) and Leave will have a separate backpay transaction line. Backpay that's calculated for all other transactions, such as KiwiSaver and ESCT, will be a combined value.

I entered the wrong backpay dates. What do I do?

If you entered the wrong backpay dates into the employee's pay rate record, you've got two options:

To change backpay to an earlier start date, you can do a "backpay on backpay". Simply update the pay rate again with the correct dates, and Jemini will calculate the difference for the additional period.

To change backpay to a later start date or address any other errors, please raise an iHelp through Infusion.

TIP

If you need to make any changes to back pay, please reach out to us for support – raise an iHelp through Infusion. We're here to help!