Initial access and setup

Access to the Range Tables bubble

This section is for Jemini consultants and system administrators who manage user access to the Range Tables bubble. If you need access, please reach out to your consultant.

How to grant access to Range Tables

Navigating to Range Tables

This section is for payroll managers or individuals who are responsible for determining salary deductions or pay allowances based on range parameters, such as salary bands or number of hours worked. Range Tables can be found in the Pay Core & Range Tables bubble.

How to navigate to Range Tables

Setting up and mantaining Range Tables

This section is for payroll managers or individuals who are responsible for setting up and maintaining Range Tables. Range Tables allow you to establish rules for automated range-based calculations for salary deductions or pay allowances, such as salary bands or number of hours worked.

Create Range Tables for salary deductions or pay allowances using one of the following table range types:

Full-Time Equivalent Salary

Actual Annual Salary

Hourly Rate

Pay Level

Gross Earning per Pay Cycle

Standard Earnings per Pay Cycle

Hours Worked per Pay Cycle

Days Worked per Pay Cycle

The table rate type can be set as:

% Pay Cycle Taxable Income

$ Amount

How to add, edit, and delete Range Tables

Choosing the best configuration approach

There are multiple ways to configure range tables using the various table range type options, as listed above. Below, we demonstrate how you can configure a range table using a common scenario as an example: Deducting PSA (Public Service Association) membership fees from an employee’s salary.

Scenario: Using Range Tables to make monthly PSA (Union) membership fee deductions based on salary ranges

NOTE

The names and numbers in this example are fictitious and shouldn’t be used as the basis for existing PSA membership fees.

Silver Fern Hospital has employees who are PSA (Union) members. Their membership fees are calculated and deducted each month based on salary ranges.

Grace, the Payroll Manager, uses Range Tables to establish calculation rules for a new transaction and apply them to employees. Each month, during the pay cycle, the fees are deducted from the employees’ actual annual salary.

These steps are expanded on below:

Creating a Range Table for deducting dollar amounts from salary ranges

.png)

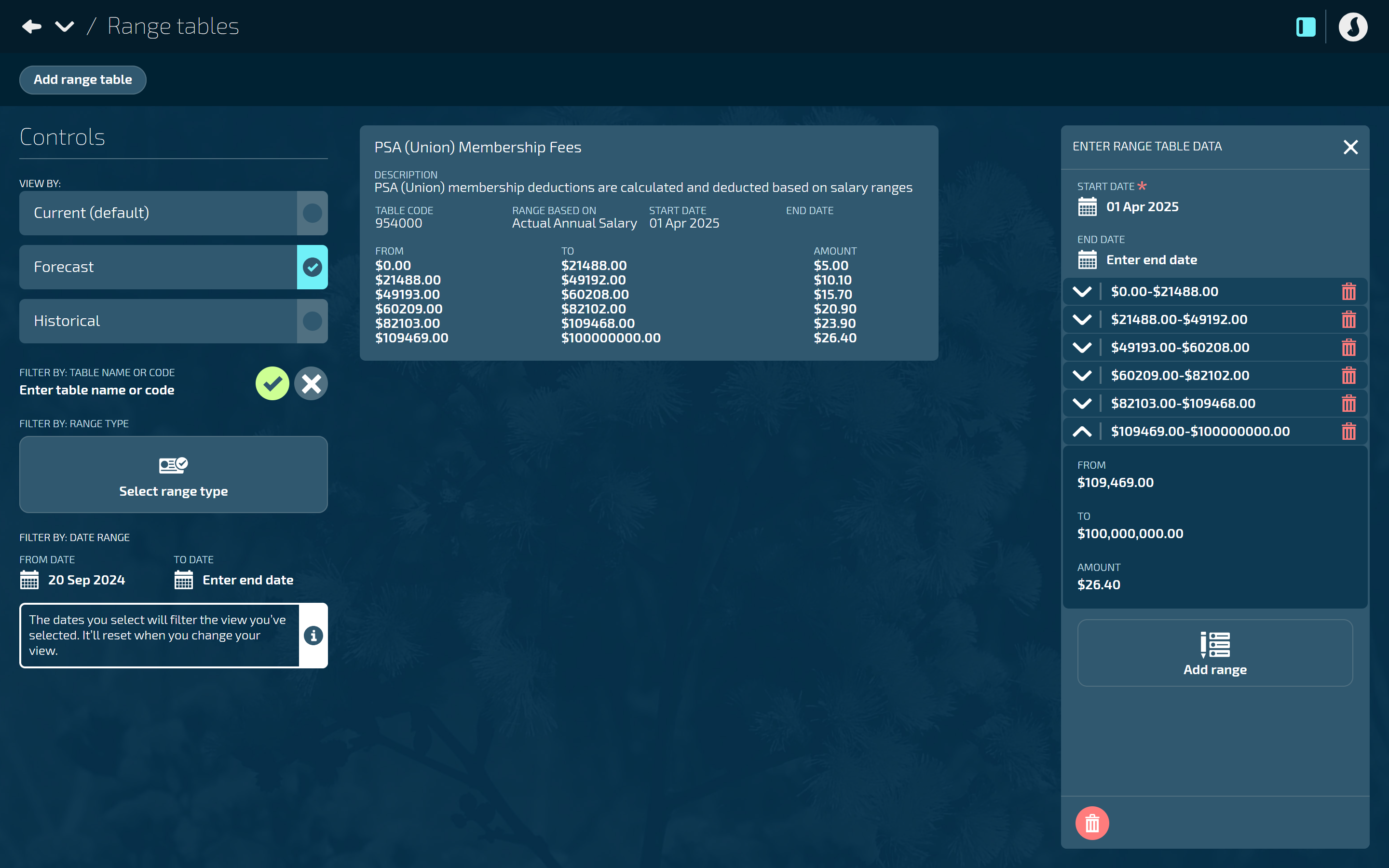

Scenario: Setting up a Range Table for PSA membership fees

When Silver Fern Hospital’s payroll manager, Grace, creates the range table in Jemini, she selects the table range type and table rate type. In this scenario, she would choose ‘Full-Time Equivalent Salary’ range type and ‘Amount’ rate type.

From there, Grace enters the range table data, including the date that the range table will be effective from. For each range, she enters the from and to amount, then enters the amount that would be deducted from each employee’s salary.

Under $21,488.00 deduct $5.00

$21,488 - $49,192 deduct $10.10

$49,193 - $60,208 deduct $15.70

$60,209 - $82,102 deduct $20.90

$82,103 - $109,468 deduct $23.90

Over $109,469.00 deduct $26.40

For step-by-step instructions, refer to How to add, edit, and delete Range Tables

Attaching a Range Table to a Pay Transaction

Range Tables can be attached to certain pay transactions, such as deductions and allowances, through the applicability settings. A new calculation type called ‘Range table’ is available to select.

.png)

Scenario: Setting up a voluntary after-tax deduction transaction for employee PSA membership fees

Once Grace, the payroll manager, has created the ‘PSA (Union) Membership Fees’ range table in Pay Core & Range Tables, she proceeds to the Payroll Transaction Configuration to create a ‘Voluntary After-Tax Deduction’ transaction. During the transaction applicability setup, she selects the new calculation type, ‘Range Table’, and chooses the ‘PSA (Union) Membership Fees’ range table from the range table backpack.

TIP

The range table backpack contents will only display current or forecast range tables. Forecast tables are only displayed if there's no current version. Historical tables will not show in the backpack.

For step-by-step instructions, refer to What's an Applicability?

Adding Range Table transactions in Pay Mode

Range-based transactions can be connected to employees in the same way that you would connect other similar transactions. When you add a range-based transaction to an employee, the details of the transaction will be displayed in their Pay Mode. Details include the range type that the table was calculated against, as seen under the Variables column.

.png)

Scenario: Attaching the PSA membership fees transaction to an employee

Flora Flanders, an employee at Silver Fern Hospital, is a PSA member and needs a voluntary after-tax deduction made each month to pay her fees. Grace, the Payroll Manager, attaches the ‘PSA membership fees’ transaction to Flora’s current pay period in Pay Mode.

For more on Pay Mode, refer to Intro to Pay Mode

Viewing range-based transactions in an employee’s payslip

Employees can view their range-based allowances or deductions in their payslip, but unlike the Pay Mode view, the range type that the table was calculated against won’t display on the employee payslip.

.png)

Scenario: Viewing PSA membership fees in a payslip

When Flora views her payslip, she can see her ‘PSA membership fee’ has been deducted from her pay, as expected.